Why Virgin Galactic Stock is Poised to Skyrocket in 2026

Posted on

Stock Analysis

Posted at

Jan 4, 2026

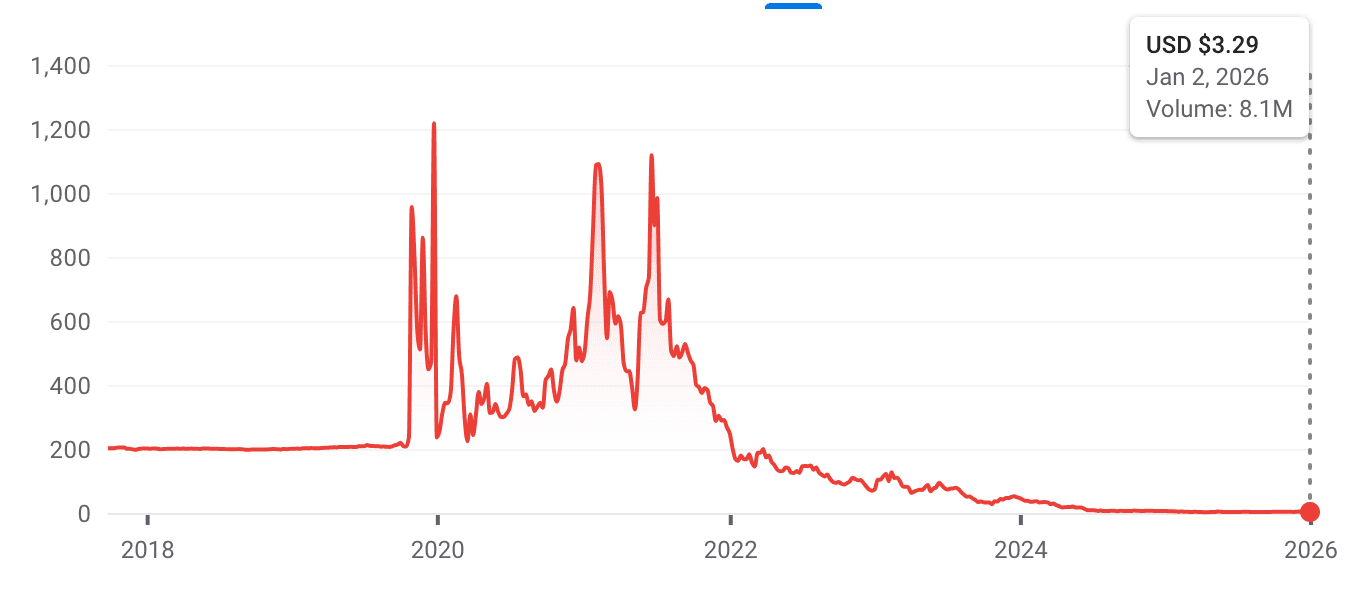

Overview of Virgin Galactic and Current Market Position

Virgin Galactic Holdings Inc. (SPCE), a pioneer in commercial space tourism, has faced significant volatility since its public debut, with its stock price reflecting the challenges of scaling spaceflight operations. As of January 4, 2026, SPCE trades at approximately $3.29 per share, following a prolonged decline from its 2021 peaks. This low valuation, however, positions the stock for substantial upside, as the company transitions from development to revenue-generating commercial flights. Historical data shows peaks above $1,000 (pre-adjustments) in early 2021, driven by hype around space innovation, but recent pressures from cash burn and delays have compressed the market cap to levels that undervalue its long-term potential. The stock appears oversold, setting the stage for a rebound as operational milestones are met.

Technological Advancements and Operational Milestones

A key driver for SPCE's potential skyrocketing in 2026 lies in its Delta-class spaceships, which are slated for commercial debut this year. These vehicles promise increased flight frequency, up to 125 annually, compared to the limited capabilities of prior models, enabling scalable operations and reduced costs per flight. The company has resolved past delays, with test flights paving the way for regular tourist missions, potentially generating hundreds of millions in revenue. This technological leap addresses previous bottlenecks like maintenance downtime and safety concerns, positioning Virgin Galactic as a leader in suborbital travel. As production ramps up, economies of scale could slash operating expenses, boosting margins and investor confidence.

Expanding Market Demand for Space Tourism

The global space tourism market is exploding, projected to grow at a 44.8% compound annual growth rate through 2030, creating a multi-billion-dollar opportunity. Virgin Galactic is uniquely positioned to capture this demand, with a backlog of high-net-worth clients willing to pay $450,000+ per ticket. As accessibility improves, broader adoption from celebrities, corporations, and even government partnerships could surge bookings. Competitors like Blue Origin face their own hurdles, giving SPCE a first-mover advantage in 2026. Rising interest in experiential luxury travel post-pandemic further amplifies this, with analysts noting untapped potential in point-to-point hypersonic travel extensions.

Financial Catalysts and Valuation Upside

Financially, 2026 marks a pivotal year with expected revenue breakthroughs from commercial services, potentially reaching $450 million annually from just two ships, over twice the current market cap at today's prices. Reduced cash burn, forecasted at lower levels as flights commence, combined with potential capital raises or partnerships, could stabilize the balance sheet. At StockProfitClub we estimate the price at $9.22 by the end of 2026, a 180% increase. Catalysts like quarterly earnings beats, new contracts, or regulatory approvals could trigger short squeezes, given high short interest.

Conclusion and Outlook for Skyrocketing Growth

In summary, SPCE's undervalued position at $3.29, coupled with 2026's commercial launch milestones, technological upgrades, and booming market demand, sets the stage for explosive growth. While risks like execution delays persist, the substantiated projections from industry growth and analyst targets suggest the stock could skyrocket multiples from current levels, rewarding patient investors. This isn't mere speculation, it's backed by tangible shifts toward profitability in a high-growth sector. For those betting on the future of space, 2026 could mark SPCE's liftoff.