Why Cloudastructure, Inc. (CSAI) Could Headline the Next Financial Story in Multifamily Security

Posted on

Stock Analysis

Posted at

Feb 16, 2026

Introduction

In the bustling world of American real estate, where apartment complexes house millions and property values soar toward the trillions, a quiet revolution is unfolding. Multifamily security has shifted from a routine expense to a critical driver of profitability, fueled by surging crime concerns, skyrocketing insurance premiums, and a relentless push for smarter, tech-driven solutions. Enter Cloudastructure, Inc. (CSAI), a NASDAQ-listed innovator whose AI-powered video surveillance and remote guarding platform is positioning it as a central figure in this evolving narrative.

As investors scan the S&P 500 and Dow Jones for the next breakout story, Cloudastructure (CSAI) stands out in the PropTech space. With its focus on multifamily housing, the company is not just offering security, it is redefining how operators protect assets, reduce costs, and enhance resident safety. This article dives deep into whether Cloudastructure, Inc. (CSAI) is truly the main character in a trending financial story, blending industry trends, company innovations, and investment angles to equip you with actionable insights. Whether you are a seasoned stock trader eyeing micro-cap gems or an everyday investor chasing financial independence, understanding CSAI's role could unlock new opportunities in 2026 and beyond.

The Multifamily Security Imperative

The U.S. multifamily sector, a cornerstone of the American dream with over 40 million rental units nationwide, faces unprecedented pressures. Property owners and managers are grappling with a perfect storm of challenges that make robust security not just desirable, but essential for safeguarding net operating income and property values.

Rising Insurance Costs and Liability Risks

Insurance premiums for multifamily properties have effectively doubled since 2021 in many markets, driven by heightened liability from security incidents. A nationwide poll highlights widespread security gaps, where inadequate measures lead to costly claims and jury awards that have surged in recent years. For operators in high-growth Sun Belt regions like Texas and Florida, these expenses can erode margins by hundreds of thousands annually per property.

Consider this: In 2025 alone, severe weather and crime-related losses pushed property insurance rates higher, with multifamily portfolios in vulnerable areas seeing deductibles climb 22 percent. Cloudastructure, Inc. (CSAI) addresses this head-on by framing security as a proactive investment, not a sunk cost.

Key Drivers of the Crisis:

Crime Statistics: Urban and suburban multifamily communities report elevated incidents, from package theft to more serious threats, prompting a 15-20 percent uptick in operator inquiries for advanced systems.

Regulatory Pressures: States like California and New York are tightening landlord responsibilities, amplifying the financial stakes.

Economic Indicators: With the S&P 500 reflecting broader market volatility, multifamily REITs are prioritizing tech to boost occupancy and rents.

The PropTech Convergence: AI as the Ultimate Equalizer

PropTech, the fusion of property and technology, is exploding. The global market is projected to reach $185 billion by 2034, growing at a 16.4 percent compound annual rate, with AI-driven solutions leading the charge. In multifamily, this means shifting from reactive guards to intelligent systems that predict and prevent issues.

Here is a quick comparison of traditional versus AI-powered approaches:

Aspect | Traditional Security | AI-Powered (e.g., Cloudastructure) |

|---|---|---|

Response Time | Minutes to hours (human-dependent) | Real-time alerts and interventions |

Cost Efficiency | High (on-site guards at $40-60/hour) | Up to 40% savings in first year |

Deterrence Rate | 60-70% (visible presence) | 98% documented crime reduction |

Scalability | Limited by geography and staffing | Cloud-based, deployable across 28 states |

Data Insights | Basic logs | Advanced analytics for operational tweaks |

This table underscores why multifamily operators, from top-15 National Multifamily Housing Council (NMHC) firms to regional players, are turning to solutions like those from Cloudastructure (CSAI). The trend aligns with broader economic shifts, where tech adoption mirrors the success of giants like Amazon in logistics, promising similar efficiencies in housing.

Cloudastructure, Inc. (CSAI) exemplifies this shift, turning multifamily security into a revenue protector amid 2026's challenges.

Cloudastructure's Technological Vanguard

At its core, Cloudastructure, Inc. (CSAI) delivers a cloud-native platform that integrates AI video surveillance, real-time remote monitoring, security analytics, and proactive remote guarding. This end-to-end system is designed for multifamily operators seeking to modernize without the headaches of fragmented legacy setups.

What sets Cloudastructure (CSAI) apart is its 98 percent real-time crime deterrence rate, achieved through automated threat detection and live verbal interventions. In 2025, the platform reviewed over 11.2 million alerts, executed more than 112,000 interventions, and boasted 96 percent AI accuracy, all while delivering 40 percent cost savings compared to traditional on-site guards.

Recent Innovations and Expansions

Cloudastructure's momentum is accelerating. Key highlights include:

Strategic Partnerships: Now collaborating with eight of the top 15 NMHC operators. A recent win involves deploying at a luxury Houston community for a top-15 firm, following a competitive review. Earlier, a national operator expanded from one to four properties across Southern metro areas, validating rapid scalability.

Footprint Growth: Operations now span 28 states and Washington, D.C., powered by mobile surveillance trailers and AI enclosures.

Tech Breakthroughs: Integration of autonomous drones with Flex Security for enhanced perimeter monitoring, plus an AI-powered security enclosure launched in early 2026. These tools extend beyond multifamily to construction sites and logistics hubs.

The company's 2025 performance tells the story: Revenue surged 270 percent to over $5 million, with Q4 alone up 306 percent, marking its strongest quarter. Total contract value hit $6.3 million, fueled by 74 percent customer growth and 99 percent retention.

For stock traders, this is more than numbers, it is proof of a scalable model in a $1.14 trillion multifamily market hungry for innovation. Cloudastructure (CSAI) is not just riding the wave, it is shaping it, much like how Netflix disrupted entertainment or Uber transformed mobility.

From Micro-Cap to Market Mover

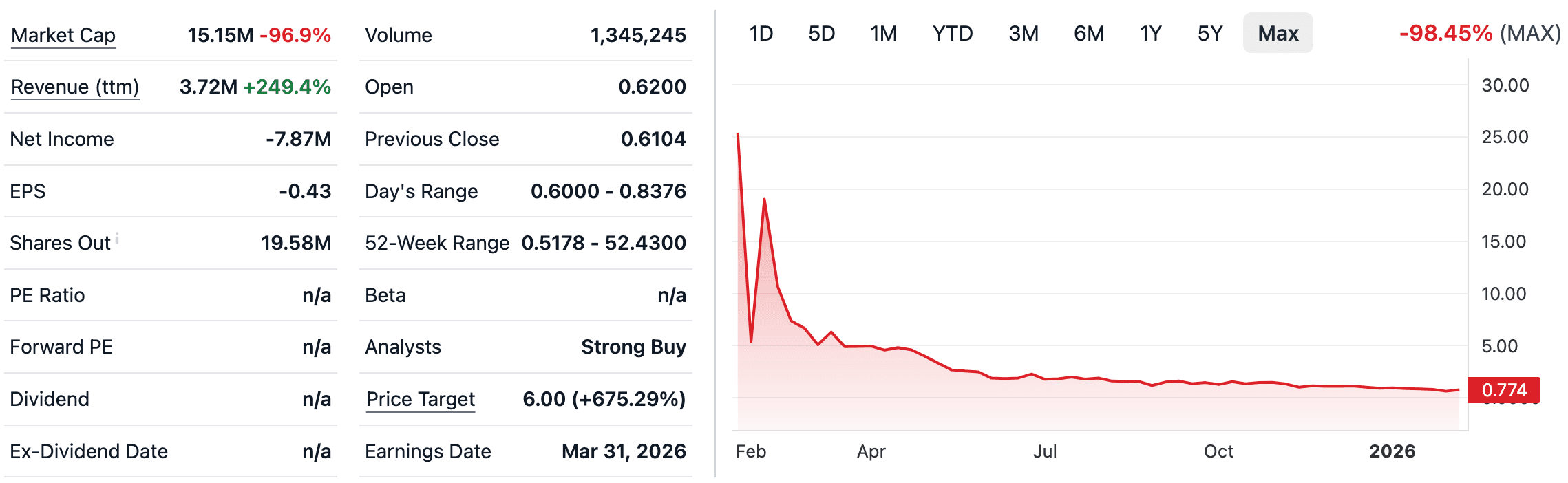

Cloudastructure, Inc. (CSAI) trades as a micro-cap on the NASDAQ, with a market capitalization around $19 million and shares hovering near $0.77 as of mid-February 2026. This positions it for high-reward potential, but also demands a nuanced investment strategy.

Performance Snapshot

Revenue Milestones: From $1.4 million in 2024 to $5 million in 2025, with analysts forecasting continued triple-digit growth into 2026.

Stock Dynamics: Shares have shown volatility, typical for emerging tech plays, but recent news spikes (e.g., partnership expansions) drove volumes to 445,000 shares. Year-to-date, it has outperformed many peers in the software-infrastructure sector.

Analyst Views: Consensus leans toward "Buy" or "Hold," with a 12-month price target of $6.00, implying over 700 percent upside from current levels. This reflects confidence in CSAI's path to profitability.

Investment Strategies for CSAI:

Long-Term Hold: Bet on the PropTech boom. Allocate 5-10 percent of a diversified portfolio, monitoring quarterly earnings for revenue beats.

Momentum Trading: Watch for catalysts like new contracts or earnings reports. Set alerts on Yahoo Finance for CSAI updates.

Risk Management: Use stop-losses at 15-20 percent below entry, given micro-cap swings. Pair with blue-chips like those in the Dow Jones for balance.

Diversification Tip: Explore related plays in AI security via ETFs tracking NASDAQ tech.

Challenges include ongoing net losses (e.g., -$7.8 million TTM) and execution risks in scaling. Yet, with low customer acquisition costs and high retention, Cloudastructure (CSAI) mirrors early-stage successes in fintech that delivered financial independence to early backers.

Positioning for the AI Security Boom

Cloudastructure, Inc. (CSAI) is not just participating in the multifamily security trend, it is emerging as its main character. From slashing crime through 98 percent deterrence to forging partnerships with industry giants, the company's AI innovations are delivering tangible value in a sector starved for solutions. Its 270 percent revenue growth in 2025, expanding footprint, and analyst-backed upside potential paint a compelling picture for 2026 and 2027.

In a market that rewards disruptors, CSAI offers a gateway to financial independence through smart stock trading and investment strategies. While risks like market skepticism remain, the fundamentals, from cost savings to scalability, suggest Cloudastructure (CSAI) could redefine multifamily operations.

Ready to capitalize? Join the StockProfitClub community today for articles, real-time alerts, and our flagship courses on trading.