Why I'm Investing in Mixed Martial Arts Group Limited (MMA) Stock in 2026

Posted on

Investing

Posted at

Feb 18, 2026

Introduction

Imagine a sport that combines the raw intensity of boxing with the strategic grappling of wrestling, captivating over 640 million fans worldwide and fueling a multibillion-dollar industry. That's mixed martial arts, or MMA, a phenomenon that's not just entertaining crowds but also creating lucrative opportunities for savvy investors. As we navigate the economic landscape of 2026, where the S&P 500 continues to reflect broader market volatility and tech giants like Apple and Amazon dominate headlines, there's a lesser-known player on the NYSE American exchange that's catching my eye: Mixed Martial Arts Group Limited (MMA). This company is at the forefront of transforming MMA from a niche combat sport into a global participation ecosystem, leveraging technology to bridge fans and fighters.

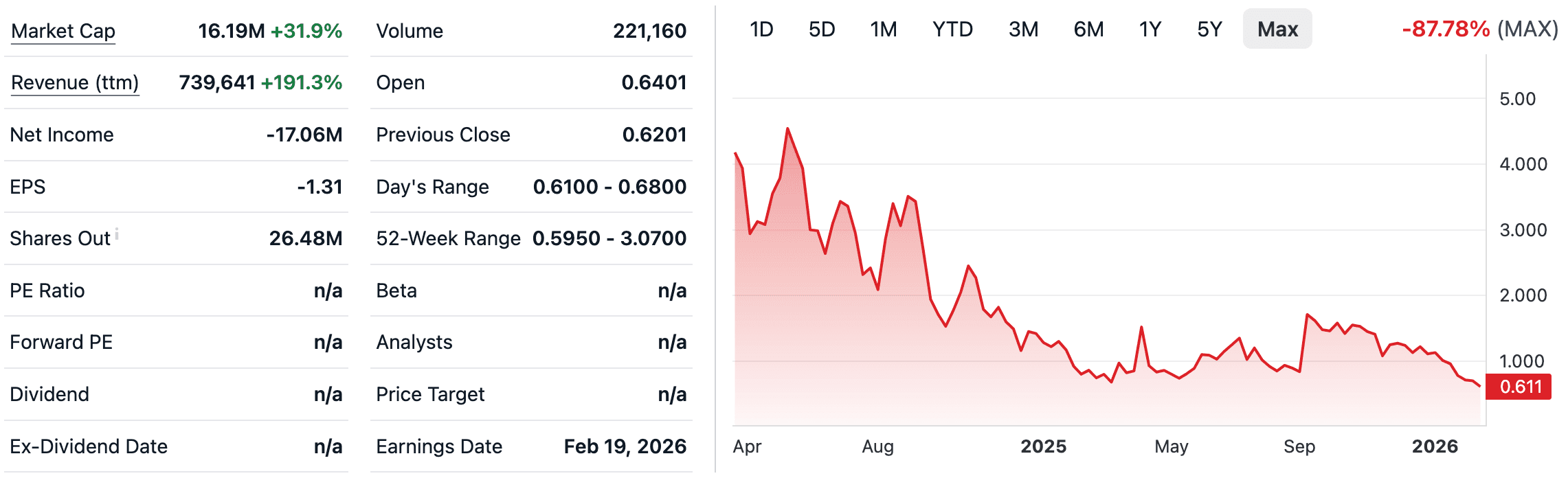

In this article, I'll explain why I'm personally investing in Mixed Martial Arts Group Limited (MMA) stock, drawing on current trends, the company's innovative business model, and a balanced risk assessment. Whether you're new to stock trading or refining your investment strategies for financial independence, this piece offers actionable insights tailored to US investors. We'll explore how MMA aligns with the growing demand for fitness and digital engagement, much like how Peloton revolutionized home workouts during the pandemic. By the end, you'll understand why this small-cap stock, trading around $0.70 with a market cap of about $18 million, could be a hidden gem in your portfolio.

Evolving Landscape of the MMA Industry in 2026

The MMA industry is exploding in 2026, driven by a perfect storm of cultural shifts, technological advancements, and economic factors. What was once viewed as a brutal spectator sport has evolved into a mainstream fitness powerhouse, with participation rates soaring across the US and beyond. According to recent market analyses, the MMA equipment sector alone is projected to reach $1.58 billion this year, growing at a compound annual growth rate (CAGR) of 4.46% through 2031. This growth mirrors broader trends in the fitness industry, where Americans are increasingly prioritizing health, much like the surge in gym memberships that boosted stocks like Planet Fitness on the NYSE.

Key Drivers of MMA Growth

Several factors are propelling the industry forward, making it an attractive arena for investments like Mixed Martial Arts Group Limited (MMA) stock:

Rising Participation and Inclusivity: Over 11 million Americans now engage in MMA-related activities, up from pre-pandemic levels. This includes a notable increase in female participants, who are drawn to the sport's emphasis on self-defense, empowerment, and overall fitness. Programs like UFC Fit are democratizing access, similar to how CrossFit expanded in the 2010s.

Technological Integration: Smart gear with sensors for performance tracking is becoming standard, enhancing training efficiency. E-commerce platforms have made equipment more accessible, boosting sales through sites like Amazon. F

Media and Broadcasting Boost: The UFC's new US media rights deal kicking in this year is expected to inject unprecedented visibility, potentially adding millions of new fans. This echoes how streaming deals propelled Netflix stock in the entertainment sector.

Global Expansion and Economic Ties: With over 45,000 gyms worldwide, MMA is tying into economic indicators like consumer spending on leisure. In the US, where the Dow Jones reflects robust consumer confidence, this translates to higher revenues for related businesses.

From an intellectual standpoint, MMA's evolution raises fascinating questions about the intersection of physical culture and digital economies. How does a sport rooted in ancient combat arts adapt to Web3 and AI? Companies like Mixed Martial Arts Group Limited are answering this by creating ecosystems that convert passive viewers into active participants, potentially disrupting traditional sports models like those of the NFL or NBA.

Challenges and Opportunities

While growth is robust, challenges include regulatory hurdles on safety gear and competition from other fitness trends. However, opportunities abound in emerging markets like Asia-Pacific, where MMA academies are proliferating. Investors eyeing stock trading in this space should consider how these trends align with broader investment strategies for financial independence, such as diversifying beyond tech-heavy NASDAQ listings.

MMA Industry Metric | 2025 Value | 2026 Projection | CAGR (2026-2031) |

|---|---|---|---|

Global Equipment Market | $1.51B | $1.58B | 4.46% |

US Participants | 10M | 11M | 10% Growth |

Gyms Worldwide | 44,000 | 45,000 | 2.3% |

This table illustrates the steady upward trajectory, underscoring why investing in Mixed Martial Arts Group Limited (MMA) stock feels timely.

Business Model and Innovations

Mixed Martial Arts Group Limited (MMA), listed on the NYSE American under the ticker MMA, is more than a stock, it's a technology-driven force reshaping the combat sports landscape. Founded in 2013 and rebranded from Alta Global Group in late 2024, the company operates as a cultural and commercial epicenter for MMA, focusing on uniting fans, participants, gyms, and practitioners through innovative platforms. With a market cap hovering around $18 million, it's a small-cap play with big ambitions, much like early-stage tech firms that scaled on NASDAQ.

Core Businesses and Operations

MMA's business model is multifaceted, emphasizing technology to address industry fragmentation. Here's a breakdown:

TrainAlta.com: This platform offers martial arts programs like the Warrior Training Program and UFC Fit, designed for beginners to pros. Powered by the Alta Community Platform, it partners with ambassadors such as Daniel Cormier (former UFC champion) and John Kavanagh (coach to Conor McGregor) to develop syllabi that blend wrestling, striking, and fitness.

The Underground & MixedMartialArts.com: A community hub for fans and practitioners, fostering engagement through forums and content. It's akin to Reddit for MMA, driving user retention and data insights.

Hype: A subscription-based mobile marketing tool for small businesses, particularly gyms, helping them grow via social media in a digital-first world.

BJJLink: A comprehensive gym management solution tailored for jiu-jitsu academies, including payment processing, marketing, and student engagement. Recent data shows 128% annualized revenue growth for BJJLink through July 2025, with SaaS subscriptions up 188%.

Intellectually, MMA's approach is intriguing: it leverages behavioral economics to convert the 700 million global MMA fans into participants. By integrating Web3 and crypto, such as tokenization on Solana and NVIDIA AI infrastructure, the company is pioneering a fan-to-participant pipeline. This could redefine loyalty in sports, similar to how blockchain transformed finance with cryptocurrencies.

Partnerships and Future Innovations

Strategic ties amplify MMA's reach. A partnership with UFC GYM plans to onboard 45 new academies in 2025, capitalizing on the UFC's 2026 media surge. Ambassadors like Laura Sanko and Eugene Bareman add credibility, reducing barriers for newcomers. Looking to 2027, MMA's Web3 platform aims to monetize fan engagement through tokens, potentially creating new revenue streams in a metaverse-like ecosystem.

For US investors, this aligns with trends in tech-sports hybrids, like DraftKings on NASDAQ. To track real-time quotes, visit NASDAQ's MMA page. If you're exploring stock trading, consider how MMA fits into investment strategies focused on emerging sectors for financial independence.

Investment Thesis

Why am I investing in Mixed Martial Arts Group Limited (MMA) stock? The thesis boils down to growth potential in a high-margin industry, underpinned by solid fundamentals and timely catalysts. As of February 2026, the stock trades at about $0.70, down from a 52-week high of $3.07 but showing resilience with recent volume spikes. This positions it as a value play for those pursuing investment strategies in undervalued small-caps.

Rewards and Growth Potential

Revenue Momentum: BJJLink's explosive growth signals scalability. With the UFC media deal, MMA could capture a share of the fan surge, potentially doubling participation revenues by 2027.

Market Positioning: As a tech enabler in a $2 billion+ equipment market, MMA benefits from trends like smart gear and e-commerce. Analysts project industry CAGR could hit 12.3% in segments like personalized training.

Valuation Appeal: At a low market cap, any positive news—like the annual report released in November 2025—could catalyze upside. Compare this to established players like Endeavor Group (UFC parent) on NYSE, where MMA offers higher growth at lower entry.

From an intellectual lens, investing here involves game theory: MMA is betting on network effects, where more users enhance platform value, much like Facebook's early days.

Risks and Mitigation

No investment is risk-free. Key concerns include:

Volatility in Small-Caps: MMA's price fluctuations mirror broader market dips, influenced by Dow Jones swings.

Competition and Regulation: Rivals in gym software or stricter safety rules could impact margins.

Execution Risks: Web3 initiatives are nascent; failure to deliver could erode confidence.

Conclusion

In summary, the MMA industry's robust growth in 2026, fueled by increasing participation, technological advancements, and major media deals, makes investing in Mixed Martial Arts Group Limited (MMA) stock a compelling choice. We've explored the evolving landscape, delved into the company's innovative business model with platforms like BJJLink and TrainAlta, and weighed the investment thesis, including risks like market volatility and rewards from Web3 integration. As trends point toward a more connected, participatory future in combat sports through 2027, MMA stands poised to capitalize, offering US investors a path to diversify beyond traditional indices like the S&P 500.

If you're serious about stock trading and building investment strategies for financial independence, now's the time to research further. Join the StockProfitClub community today to access exclusive insights, sign up for our courses on emerging market investments, or read related articles