Why New Horizon Aircraft Ltd (HOVR) Is the eVTOL Stock Ready to Soar in 2026

Posted on

Stock Analysis

Posted at

Jan 7, 2026

Introduction to New Horizon Aircraft Ltd

As we enter 2026, the advanced air mobility sector is poised for significant breakthroughs, and New Horizon Aircraft Ltd (NASDAQ: HOVR) stands out as a compelling investment opportunity. Formerly known as Horizon Aircraft, the company specializes in hybrid electric vertical takeoff and landing (eVTOL) aircraft, focusing on practical, high-performance solutions for regional transportation, medical evacuations, and disaster response. With its flagship Cavorite X7 aircraft, New Horizon aims to address real-world challenges like range limitations and operational reliability that plague many pure-electric competitors. Trading at around $1.85 per share as of early January 2026, the stock offers substantial upside potential for investors eyeing the burgeoning eVTOL market. The company's emphasis on hybrid technology positions it uniquely in a field dominated by battery-dependent designs, making it a stock worth considering for growth-oriented portfolios this year.

Innovative Technology and the Cavorite X7 Edge

At the heart of New Horizon's appeal is its patented HOVR wing technology and hybrid-electric power system in the Cavorite X7. This aircraft combines vertical takeoff capabilities with conventional flight efficiency, offering a max speed of 450 km/h, an 800 km range with reserves, and capacity for up to six passengers plus a pilot—all while carrying a 1,500-pound useful load. Unlike fully electric eVTOLs limited by battery constraints, the Cavorite X7's onboard generator enables self-charging, extending operational flexibility for missions in remote or challenging environments. Recent developments, including partnerships with high-performance engineering firms and an expanding team of experts in aerodynamics and propulsion, underscore the company's progress toward a full-scale prototype by the end of 2026. This hybrid approach not only enhances safety and durability but also aligns with defense sector needs, as highlighted by ex-military leaders in the company's ranks, positioning New Horizon for potential government contracts and diversified revenue streams.

Explosive Growth in the eVTOL Market

The eVTOL industry is on a trajectory of rapid expansion, with market valuations projected to soar from approximately $1.19 billion in 2025 to between $4.36 billion and $28.6 billion by 2030, driven by urban air mobility demands and sustainable transportation initiatives. Compound annual growth rates (CAGRs) ranging from 29.65% to 54.9% reflect increasing investments, regulatory advancements like the FAA's powered-lift frameworks, and battery tech improvements enabling longer ranges. North America, where New Horizon is based, is expected to lead with a 36.5% market share, fueled by urban congestion solutions and supportive policies. As cities integrate vertiports and air taxi services, companies like New Horizon, with their focus on practical, hybrid solutions, are well-placed to capture a slice of this multi-billion-dollar opportunity, especially as global fleets could reach 30,000 eVTOLs by 2045.

Financial Performance and Analyst Optimism

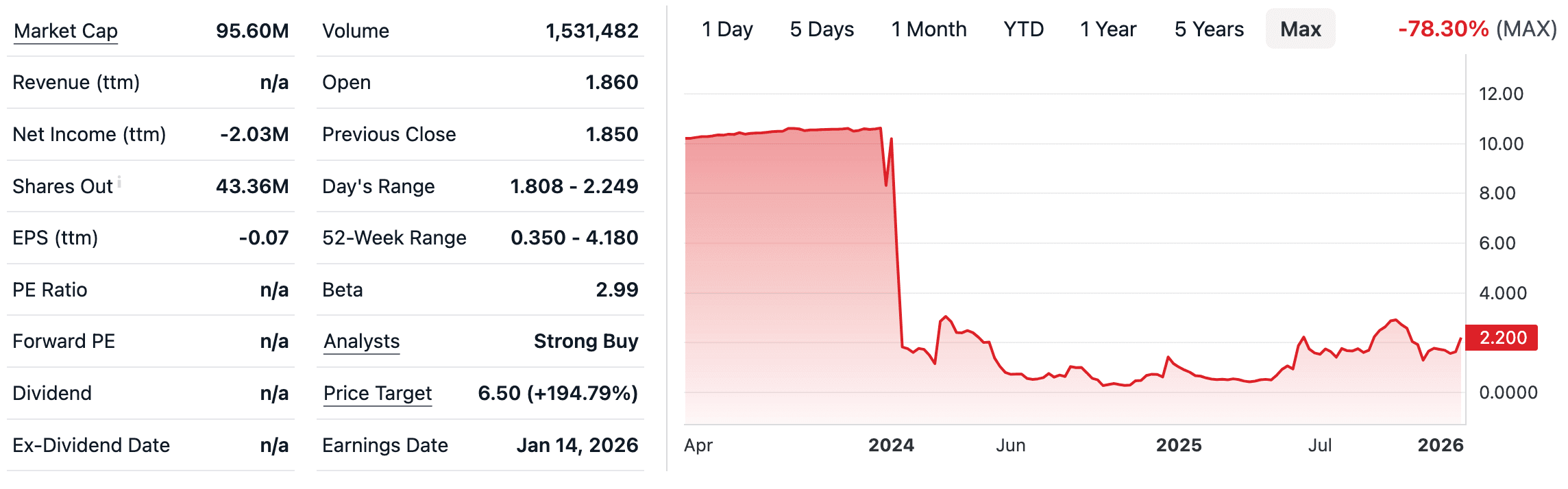

Despite being in the development phase with projected 2026 earnings of around -$2 million, New Horizon's stock has garnered strong analyst support, with a consensus "Strong Buy" rating from multiple Wall Street firms. Price targets average $6.50, implying over 250% upside from current levels, with highs reaching $11. The company's micro-cap status (market cap ~$84 million) offers high-growth potential, bolstered by upcoming milestones like the Q2 2026 business update on January 14. Recent X discussions highlight positive momentum, including technical upgrades and board additions like fighter pilot Jameel Janjua, signaling robust leadership for scaling operations. While risks like negative earnings persist, the stock's short-term buy signals from moving averages suggest accumulation opportunities in 2026.

Key Catalysts for 2026 and Beyond

2026 could be a pivotal year for New Horizon, with the full-scale Cavorite X7 build completion serving as a major catalyst for stock appreciation. Regulatory tailwinds, such as the U.S. Department of Transportation's AAM Implementation Plan, are accelerating certification paths, potentially enabling commercial operations by 2028. Partnerships in defense and regional mobility, combined with global eVTOL fleet projections of 600 units in service by 2030, position the company for revenue inflection. Investor sentiment on platforms like X remains bullish, with discussions around earnings calls and hybrid advantages fueling interest. For those seeking exposure to innovative aerospace tech amid a market ripe for disruption, HOVR represents a strategic buy in 2026, backed by technological edge, market growth, and analyst confidence.