Why Intuitive Machines (LUNR) is an Interesting Stock to Watch in 2026

Posted on

Stock Research

Posted at

Jan 10, 2026

Introduction

In the rapidly evolving space economy, Intuitive Machines, Inc. (NASDAQ: LUNR) stands out as a compelling investment opportunity. As a leader in lunar exploration and infrastructure, LUNR is positioned to capitalize on NASA's Artemis program, commercial space ventures, and the growing demand for lunar services. With recent acquisitions, government contracts, and ambitious projects, this stock offers high growth potential for investors interested in space stocks, aerospace innovation, and long-term lunar economy plays.

Company Overview

Intuitive Machines was founded in 2013 with a mission to open access to the Moon for the progress of humanity, creating a blueprint to commercialize our solar system. Headquartered in Houston, Texas, the company boasts over 400 employees and an executive team with more than 250 combined years of aerospace experience. LUNR specializes in lunar landers, satellite constellations, and infrastructure services, focusing on delivery, data transmission, and scalable on-demand lunar access.

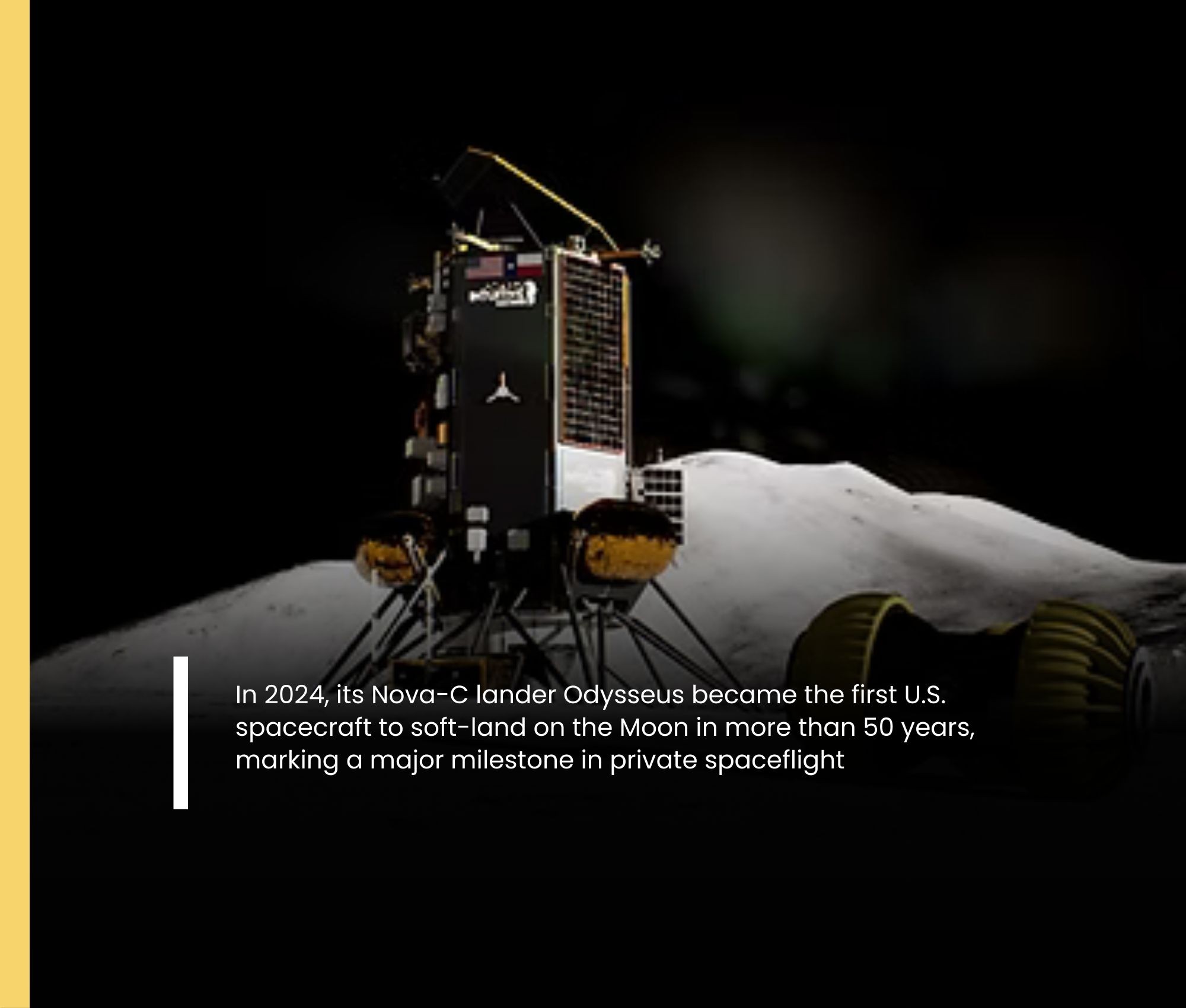

The company's core offerings include the Nova-C lunar lander family for payload delivery, advanced satellites for 4K streaming, navigation, and communications, and foundational systems for scientific data collection and system monitoring. This positions Intuitive Machines as a key player in enabling sustainable living and working on the Moon.

Key Achievements and Projects

Intuitive Machines has already completed four NASA lunar missions, demonstrating its technical prowess. A major milestone is its role in NASA's Near Space Network (NSNS), where it plans to deploy the first of five satellites to the Moon in mid-2026 for lunar communications and GPS-like services. The recent acquisition of Lanteris Space Systems enhances its satellite manufacturing capabilities, expanding into defense and commercial sectors.

The Nova-C lander, central to missions like IM-3 scheduled for the second half of 2026, supports science payloads, precursor missions, and cargo resupply. Additionally, B. Riley analysts highlight LUNR as a key beneficiary of the White House's order to accelerate lunar missions, underscoring its strategic importance in the Artemis program.

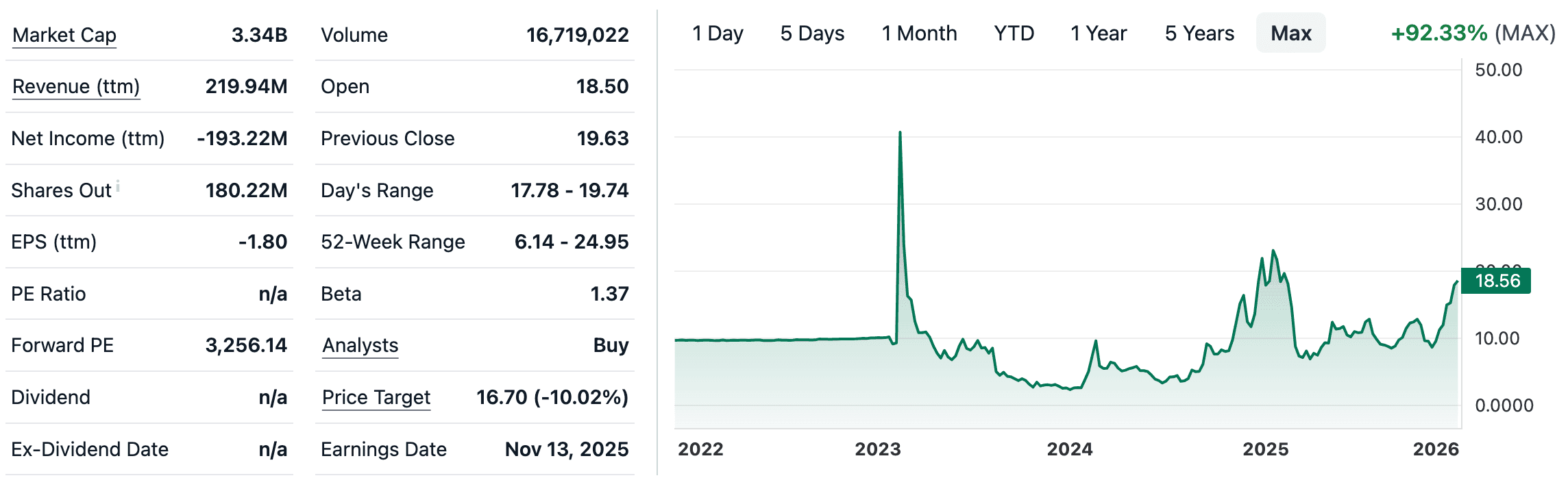

Stock Performance

LUNR's stock has shown remarkable volatility and upside. After a 610% surge in 2024 and a 10.6% dip in 2025, shares are up 21% year-to-date in 2026, trading around $19.63 with a market cap of approximately $3.5 billion. Analysts project robust growth, with revenue potentially reaching $502 million by 2028 (30.5% annual growth) or even $919 million in 2026, driven by contracts and acquisitions.

Future Prospects

Looking ahead, Intuitive Machines is evolving into the "toll collector" of the lunar economy through its NSNS contract, providing recurring SaaS-like revenue from data relay services for rovers, landers, and astronauts. The Lunar Terrain Vehicle contract, potentially worth $600-800 million, could be a game-changer, though political uncertainties loom.

With institutional ownership at 72% from firms like BlackRock and Vanguard, and the space sector's shift toward commercialization, LUNR offers deep value at less than 4x 2026 sales.