Top Small-Cap Biotechnology Stocks to Buy in 2026

Posted on

Investing

Posted at

Jan 4, 2026

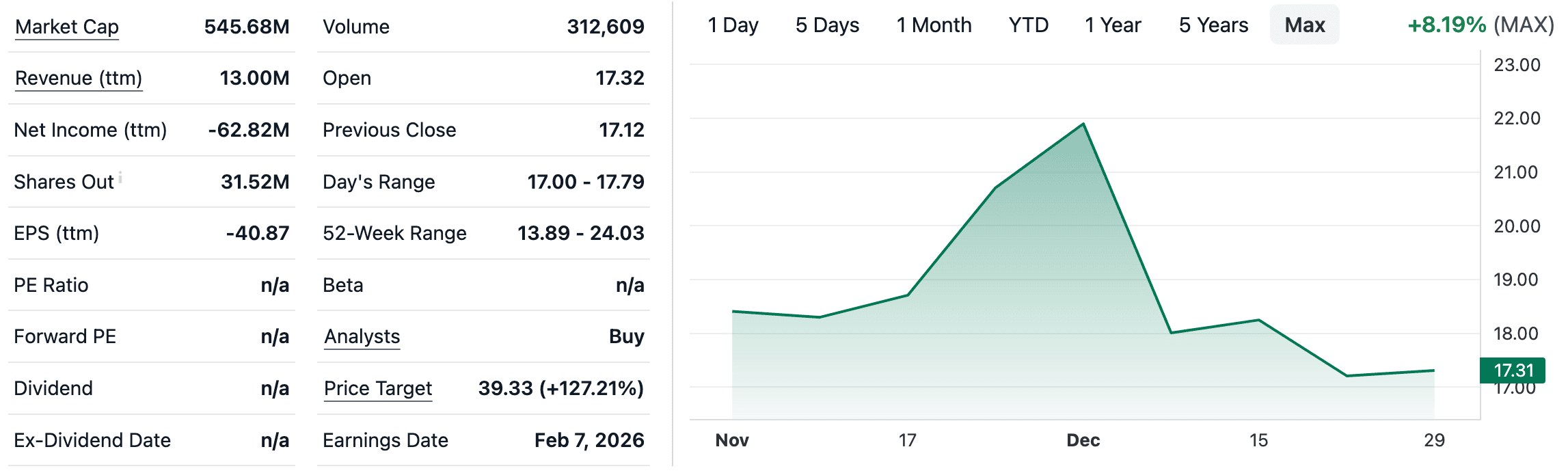

Silence Therapeutics plc (SLN)

Silence Therapeutics specializes in RNA interference (RNAi) technology, designing siRNA molecules to silence disease-causing genes. The company's platform, GalNAc-conjugated siRNA, targets liver-related disorders, with applications in cardiovascular, hematological, and rare diseases. Key partnerships with AstraZeneca and Mallinckrodt bolster its development efforts, providing milestone payments and royalties.

In 2026, Silence is poised for growth as Phase 2 trials for lead candidates like SLN360 (for high lipoprotein(a)) and SLN124 (for polycythemia vera) advance. Analysts project revenue growth of 47.6% annually, with EPS improving by 22.6%. Why buy? Undervalued amid a bullish consensus, with potential FDA breakthroughs driving share appreciation. Risks include trial delays, but the RNAi market's expansion makes SLN a high-reward pick.

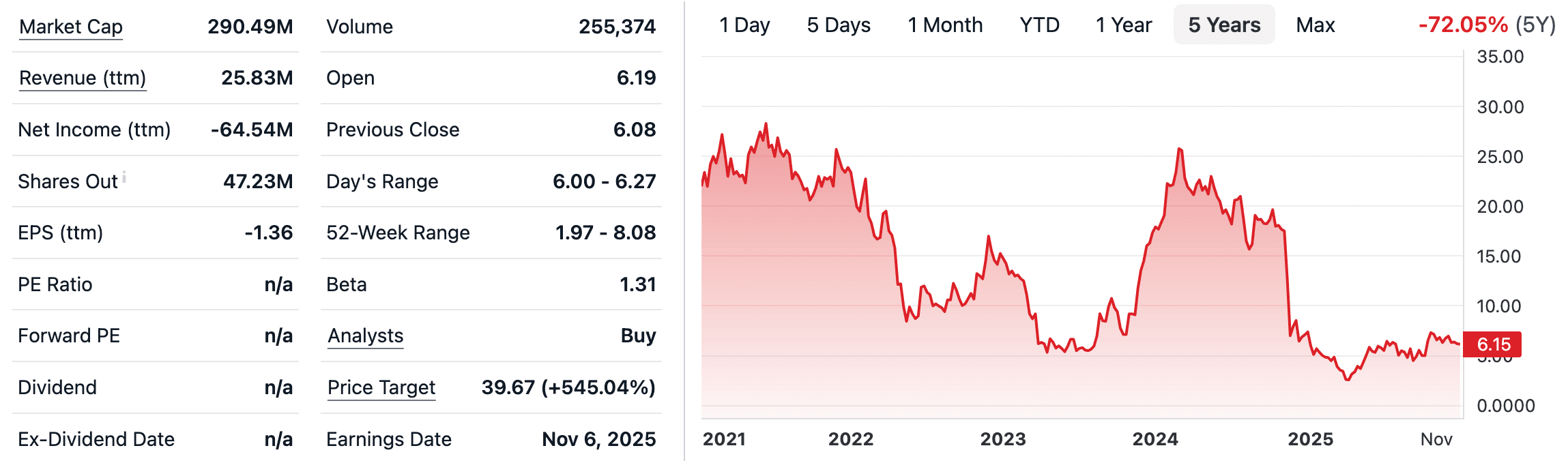

Tonix Pharmaceuticals Holdings (TNXP)

Tonix focuses on central nervous system (CNS) disorders, infectious diseases, and immunology, with a portfolio including fibromyalgia treatments and COVID-19 vaccines. Its lead candidate, Tonmya (for fibromyalgia), recently gained FDA priority review, potentially launching in 2026.

The company's outlook is optimistic, revenue is expected to surge 151% quarterly by late 2026, driven by commercialization. Why buy in 2026? Regulatory approvals and a broad pipeline position Tonix for market share in underserved areas like chronic pain. With a "Buy" rating from analysts, it's ideal for growth-oriented portfolios, though volatility from clinical risks persists.

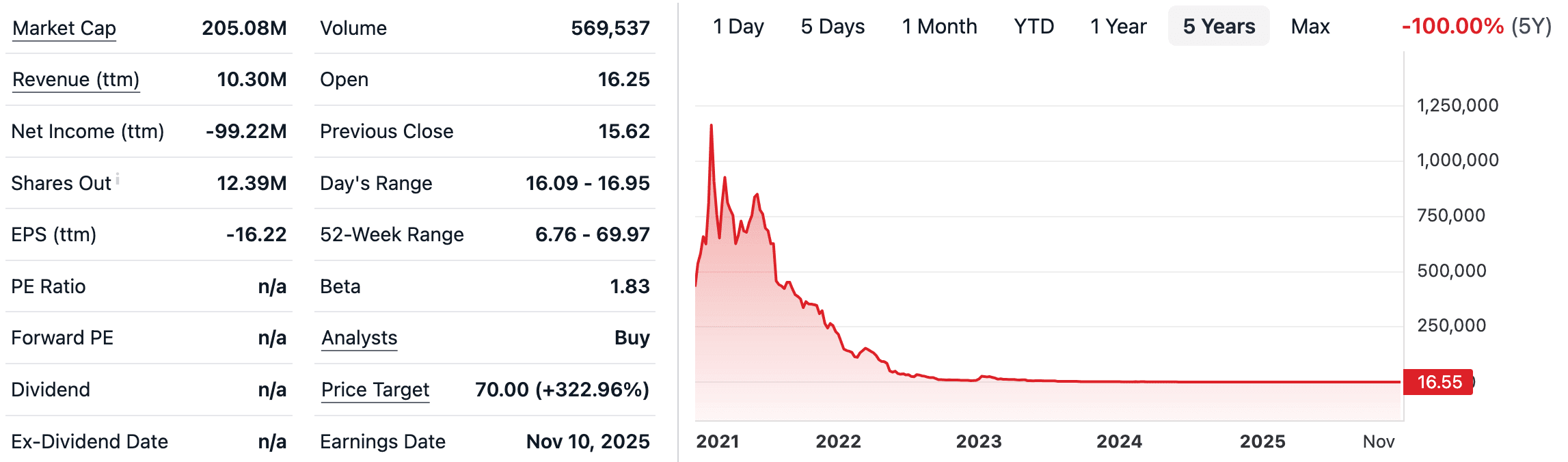

LENZ Therapeutics, Inc. (LENZ)

LENZ develops non-invasive eye drops for presbyopia, a common age-related vision issue. Its flagship product, VIZZ (aceclidine-based drops), received FDA approval in late 2025, marking a shift from traditional reading glasses.

We anticipate revenue growth in 2026, fueled by VIZZ's launch, the growth trajectory outpaces the industry's 9% average. Why buy? VIZZ's consumer appeal could disrupt a $5 billion market, with commercialization ramping up. LENZ trades at a 95% discount to fair value estimates, making it a undervalued gem. Consumer adoption is key, but positive trial data mitigates risks.

Whitehawk Therapeutics, Inc. (WHWK)

Whitehawk, formerly Aadi Bioscience, focuses on antibody-drug conjugates (ADCs) for solid tumors, leveraging next-generation topoisomerase 1 inhibitors (TOP1i). Its three-asset portfolio targets validated antigens in underserved cancers.

With $162.6 million in cash providing runway into 2028, Whitehawk is set for Phase 1 trials in 2026. Why buy? Positioned in the booming ADC market (projected $35 billion by 2030), Whitehawk offers 180-200% upside potential. Insider buys signal confidence, though early-stage risks like trial failures apply.

Evommune, Inc. (EVMN)

Evommune develops therapies for autoimmune and inflammatory diseases, with EVO756 (MRGPRX2 antagonist) and EVO301 (IL-18 inhibitor) in Phase 2 for atopic dermatitis, urticaria, and ulcerative colitis.

Post-IPO in 2025, Evommune has $172.5 million raised, funding three Phase 2 readouts in 2026. Revenue growth is forecasted at 43.3% annually, though losses persist short-term. Why buy? Positive trial data could catalyze gains, with a focus on high-unmet-need areas. Cash position ensures execution, outweighing pipeline risks.