Top 5 Dividend Stocks for 2026

Posted on

Investing

Posted at

Jan 24, 2026

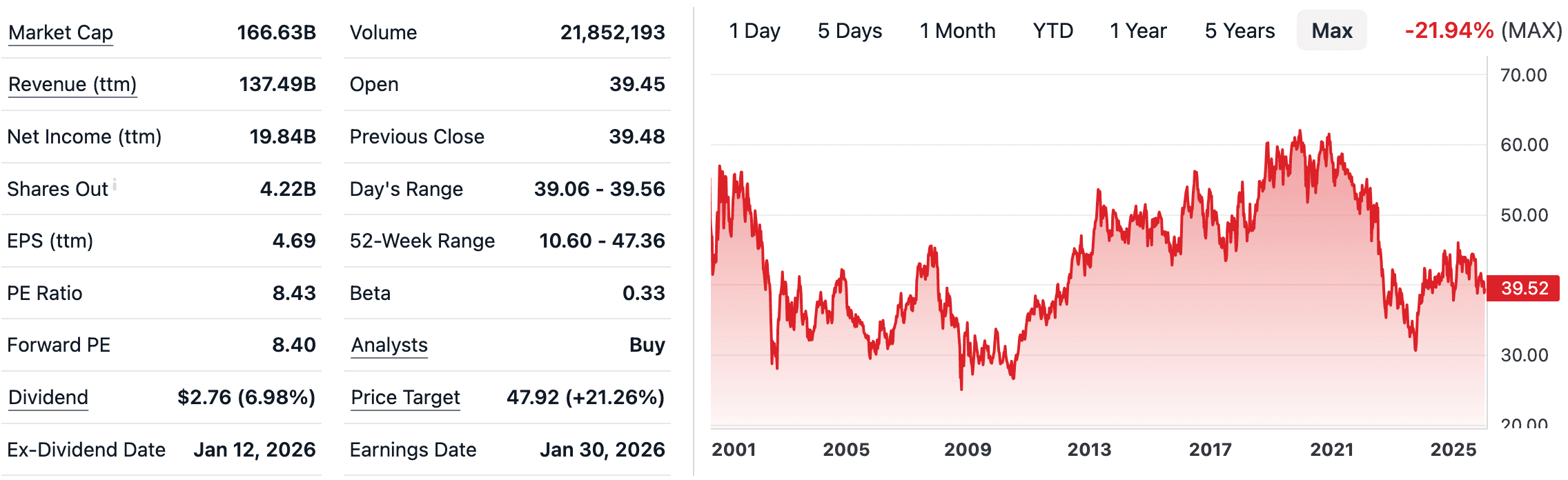

Verizon Communications (VZ)

As one of America's leading wireless carriers, Verizon benefits from the essential nature of telecommunications services, providing a defensive moat in virtually any economic environment. The company's extensive 5G network infrastructure and loyal customer base create predictable recurring revenues that support its generous dividend policy.

Financial Strength Analysis

What makes Verizon particularly attractive is the healthy relationship between its operational efficiency and capital structure. With a gross margin of 59.40% against a debt ratio of 45.56%, Verizon demonstrates that its core business generates substantial profitability that comfortably exceeds its leverage. This 13.84 percentage point margin of safety suggests the company earns significantly more from operations than it owes relative to total assets, a crucial indicator of dividend sustainability.

The telecommunications sector is capital-intensive by nature, requiring substantial investment in network infrastructure and spectrum licenses. Despite these demands, Verizon has maintained disciplined financial management while continuing to invest in future growth opportunities. The company's ability to generate nearly 60 cents of gross profit on every dollar of revenue provides ample cushion to service debt, fund capital expenditures, and maintain dividend payments.

Investment Considerations

For income-focused investors, Verizon represents a rare opportunity to earn nearly 7% annual income from a blue-chip company with decades of operating history. The stock's defensive characteristics make it particularly appealing for retirees or conservative investors seeking reliable cash flow. While the wireless industry faces competitive pressures and technological disruption, Verizon's scale advantages and established infrastructure create significant barriers to entry that protect its market position and dividend-paying capacity.

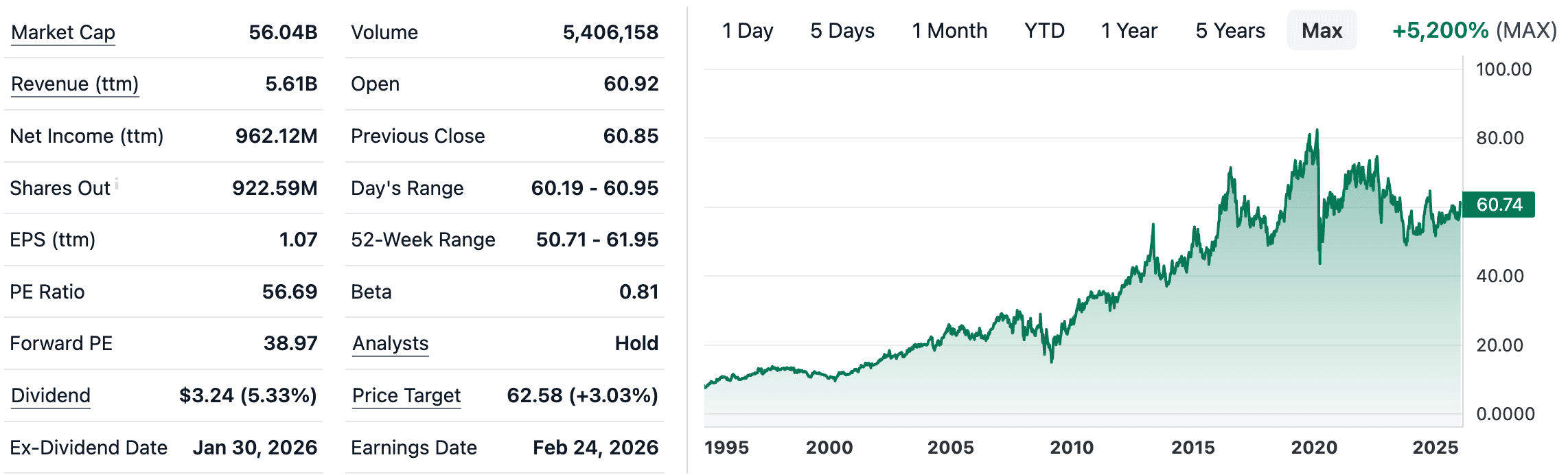

Realty Income (O)

Realty Income has earned the nickname "The Monthly Dividend Company" through its distinctive policy of distributing dividends 12 times per year rather than quarterly. Currently yielding 5.33%, this real estate investment trust (REIT) specializes in single-tenant commercial properties leased under long-term net lease agreements. The company's diversified portfolio spans retail, industrial, and other commercial real estate sectors, with tenants including industry-leading brands operating in recession-resistant businesses.

Financial Strength Analysis

Realty Income demonstrates exceptional financial metrics that distinguish it even among quality REITs. The company's gross margin of 92.70% stands as the highest among our five selections, reflecting the high-margin nature of its net lease business model where tenants bear most property operating expenses.

This substantial gap between profitability and leverage is particularly significant in the REIT sector, where companies typically carry higher debt levels to acquire income-producing properties. Realty Income's superior positioning allows it to maintain financial flexibility while pursuing growth opportunities through property acquisitions. The company's investment-grade credit rating and access to low-cost capital further enhance its ability to grow both its property portfolio and dividend over time.

Investment Considerations

The monthly dividend schedule offers practical advantages for investors relying on dividend income to cover regular expenses. Realty Income's five-decade history includes consistent dividend growth, having increased its dividend 127 times since the company's listing in 1994. The diversification across thousands of properties and hundreds of different tenants reduces concentration risk, while the focus on essential and service-oriented retail provides resilience against e-commerce disruption. For investors seeking steady, predictable income with potential for long-term growth, Realty Income represents a cornerstone holding.

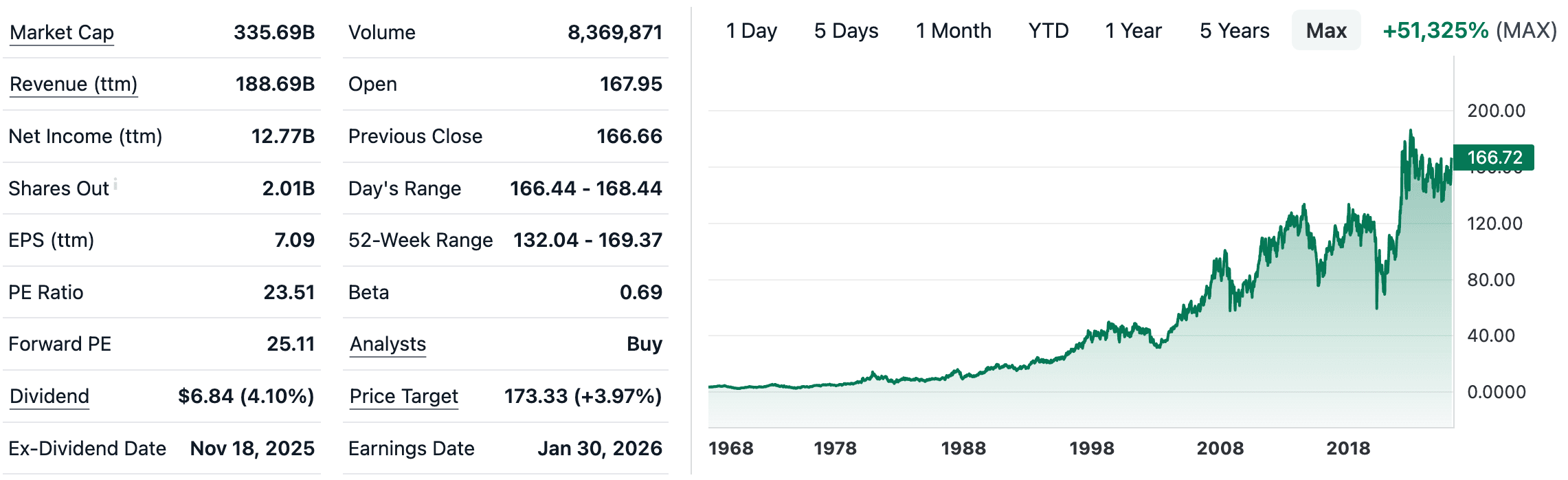

Chevron (CVX)

Chevron Corporation, one of the world's largest integrated energy companies, offers a 4.10% dividend yield backed by operations spanning oil and gas exploration, production, refining, and chemicals. With over 35 consecutive years of dividend increases, Chevron has demonstrated unwavering commitment to shareholder returns through multiple energy price cycles. The company's global scale, diversified asset base, and operational excellence position it as a leader in traditional energy while it gradually transitions toward lower-carbon solutions.

Financial Strength Analysis

Among energy sector peers, Chevron stands out for conservative financial management. Its debt ratio of just 16.17% ranks as the lowest in our selection, reflecting management's disciplined approach to capital allocation and balance sheet strength. While the gross margin of 29.28% might appear modest compared to other stocks in this analysis, it's important to understand this figure in the context of the integrated energy business model, where margins vary significantly between upstream exploration and downstream refining operations.

The 13.11 percentage point spread between gross margin and debt ratio demonstrates Chevron's conservative leverage approach. This financial cushion proved invaluable during the 2020 oil price collapse when the company maintained its dividend while many competitors cut payouts. Chevron's fortress balance sheet enables it to invest counter-cyclically, acquiring assets at attractive prices during downturns while maintaining steady dividends. The company's strong free cash flow generation capability and substantial reserves provide confidence in long-term dividend sustainability.

Investment Considerations

Investing in Chevron offers exposure to essential energy commodities that remain critical to global economic function despite the ongoing energy transition. The company's dividend track record speaks to management's shareholder-friendly philosophy, while its financial strength provides downside protection during sector volatility. For investors comfortable with commodity price exposure and seeking above-market yield with inflation protection characteristics, Chevron merits consideration. The stock serves as both an income vehicle and a hedge against rising energy prices, offering diversification benefits within a balanced portfolio.

The Coca-Cola Company (KO)

The Coca-Cola Company exemplifies the power of enduring brand equity and global distribution excellence. With a 2.80% dividend yield, Coca-Cola may offer more modest income than others in this selection, but it compensates through exceptional consistency and growth potential. As a Dividend King with over 60 consecutive years of dividend increases, Coca-Cola has rewarded patient investors through bull markets and bear markets alike. The company's portfolio of over 200 beverage brands reaches consumers in more than 200 countries, creating one of the most valuable franchise systems in global commerce.

Financial Strength Analysis

Coca-Cola's financial profile reveals the economics of a capital-light business model built on intangible assets. The company's gross margin of 61.63% reflects exceptional pricing power and operational efficiency in beverage concentrate production. Against a debt ratio of 47.90%, Coca-Cola maintains a healthy 13.73 percentage point margin, demonstrating that profitability substantially exceeds leverage. While the debt ratio sits near the middle of our selection, this must be understood in context: Coca-Cola operates an asset-light model where much of the bottling and distribution infrastructure is owned by independent partners.

This strategic approach allows Coca-Cola to generate high returns on invested capital while maintaining financial flexibility. The company's debt largely funds share repurchases and strategic acquisitions that expand the beverage portfolio rather than physical infrastructure. Strong cash flow generation, over $10 billion in recent years, easily services debt obligations while funding consistent dividend growth. The power of Coca-Cola's brands creates pricing power that protects margins even during inflationary periods, a crucial advantage for long-term dividend sustainability.

Investment Considerations

For dividend growth investors, Coca-Cola represents a cornerstone holding that balances current income with the potential for rising payouts over time. The company's 60-year streak of annual dividend increases demonstrates management's commitment to returning value to shareholders through all economic environments. While facing headwinds from changing consumer preferences toward healthier beverages, Coca-Cola has successfully diversified beyond carbonated soft drinks into water, sports drinks, coffee, and tea. The stock's defensive characteristics, people drink beverages in good times and bad, make it particularly suitable for conservative investors seeking predictable, growing income.

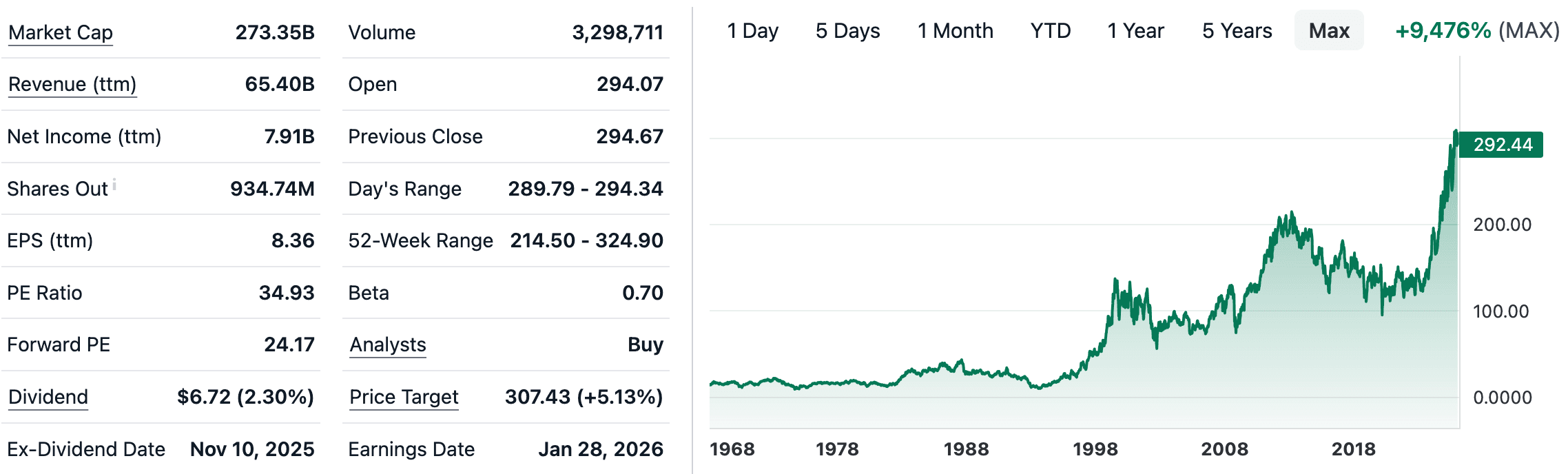

International Business Machines (IBM)

International Business Machines Corporation (IBM) offers technology sector exposure with a mature company's dividend commitment. Yielding 2.30%, IBM provides lower income than others in this selection but represents the only pure technology holding. The company has undergone significant strategic transformation in recent years, divesting legacy businesses to focus on hybrid cloud computing and artificial intelligence. Through its Red Hat acquisition and growing consulting practice, IBM targets high-value enterprise technology services where recurring revenues and long-term client relationships create business stability.

Financial Strength Analysis

IBM's financial metrics reveal a company in transition balancing transformation investments with financial discipline. The gross margin of 57.81% demonstrates the profitable nature of software and services businesses that now dominate IBM's revenue mix.

This tighter spread reflects the capital requirements of IBM's business transformation and the debt incurred for strategic acquisitions like Red Hat. However, the company's improving fundamentals deserve recognition. Revenue has stabilized after years of decline, free cash flow has strengthened, and the strategic pivot toward cloud and AI positions IBM to capture growth in these expanding markets. The company's enterprise client relationships create substantial switching costs and recurring revenue streams that support dividend payments even as the business evolves.

Investment Considerations

IBM appeals to investors seeking technology exposure without abandoning dividend income. While the yield trails traditional dividend sectors, it significantly exceeds what most technology stocks offer. The company's focus on hybrid cloud and artificial intelligence positions it to benefit from long-term secular trends as enterprises modernize their technology infrastructure. For patient investors willing to accept transformation risk in exchange for participation in technology growth plus meaningful current income, IBM presents an intriguing value proposition. The stock suits investors who want portfolio diversification into technology while maintaining a commitment to regular dividend income.