The AI Investment Hype: Historical Lessons for Prudent Investors

Posted on

Investing

Posted at

Jan 29, 2026

AI Bubble: Why History Demands Caution

In the fast-paced world of the US stock market, artificial intelligence (AI) has captured the imagination of investors everywhere. As we navigate through 2026, stocks like Nvidia (NVDA) and Broadcom (AVGO) continue to soar on NASDAQ, driven by promises of revolutionary productivity gains and endless innovation. The S&P 500 and Dow Jones indices reflect this enthusiasm, with AI-related companies leading the charge. But amid the excitement, whispers of an "AI bubble" grow louder. Experts are debating whether this surge mirrors past market manias, where hype outpaced reality, leading to sharp corrections.

Have you invested in AI stocks this year? Is the AI bubble a golden opportunity or a ticking time bomb?

Understanding the AI Bubble Phenomenon

The term "AI bubble" refers to a situation where investor enthusiasm inflates stock prices beyond their fundamental value, often fueled by speculation rather than solid earnings. In simple terms, a bubble forms when prices rise rapidly due to hype, only to burst when reality sets in, causing significant losses. For instance, the price-to-earnings (PE) ratio, which measures if a stock is overvalued by comparing its price to earnings per share, has skyrocketed for many AI firms in 2026. Nvidia's PE ratio hovers around levels not seen since the dot-com era, signaling potential overvaluation.

What Drives the AI Bubble?

Several factors contribute to the current AI bubble. First, massive capital inflows from mega-cap companies are pouring into AI infrastructure, with projections estimating $1.1 trillion in spending between 2026 and 2029. This includes hyperscalers like Microsoft and Amazon Web Services building data centers for AI models. However, much of this investment relies on future promises, not immediate profits. Wall Street analysts note that while AI boosts productivity in sectors like healthcare and finance, the monetization lag can take years, leading to detached valuations.

Second, market concentration plays a role. The "Magnificent Seven" tech stocks dominate the S&P 500, accounting for over 30% of its value, the highest in decades. This echoes past bubbles where a few leaders masked broader market vulnerabilities. For US investors, this means diversified portfolios in retirement accounts like 401(k)s could still suffer if the AI bubble bursts, primarily impacting large-cap tech.

Signs of Hype in 2026

As of January 2026, indicators point to sustained AI hype. Reports show 95% of organizations investing in generative AI see zero returns despite billions spent. Yet, stock trading volumes on NASDAQ remain high, driven by FOMO (fear of missing out). Economic indicators like rising interest rates could exacerbate this, as cheaper borrowing fueled the initial boom. To spot overvaluation, look at non-traditional metrics: companies touting AI involvement without proven revenue streams often signal red flags. For beginners, the AI bubble offers a lesson in stock investing strategies: focus on fundamentals like earnings growth over buzz. Secondary keywords like investment strategies and stock trading apply here, always check SEC filings for transparency.

Lessons from Past Tech Revolutions

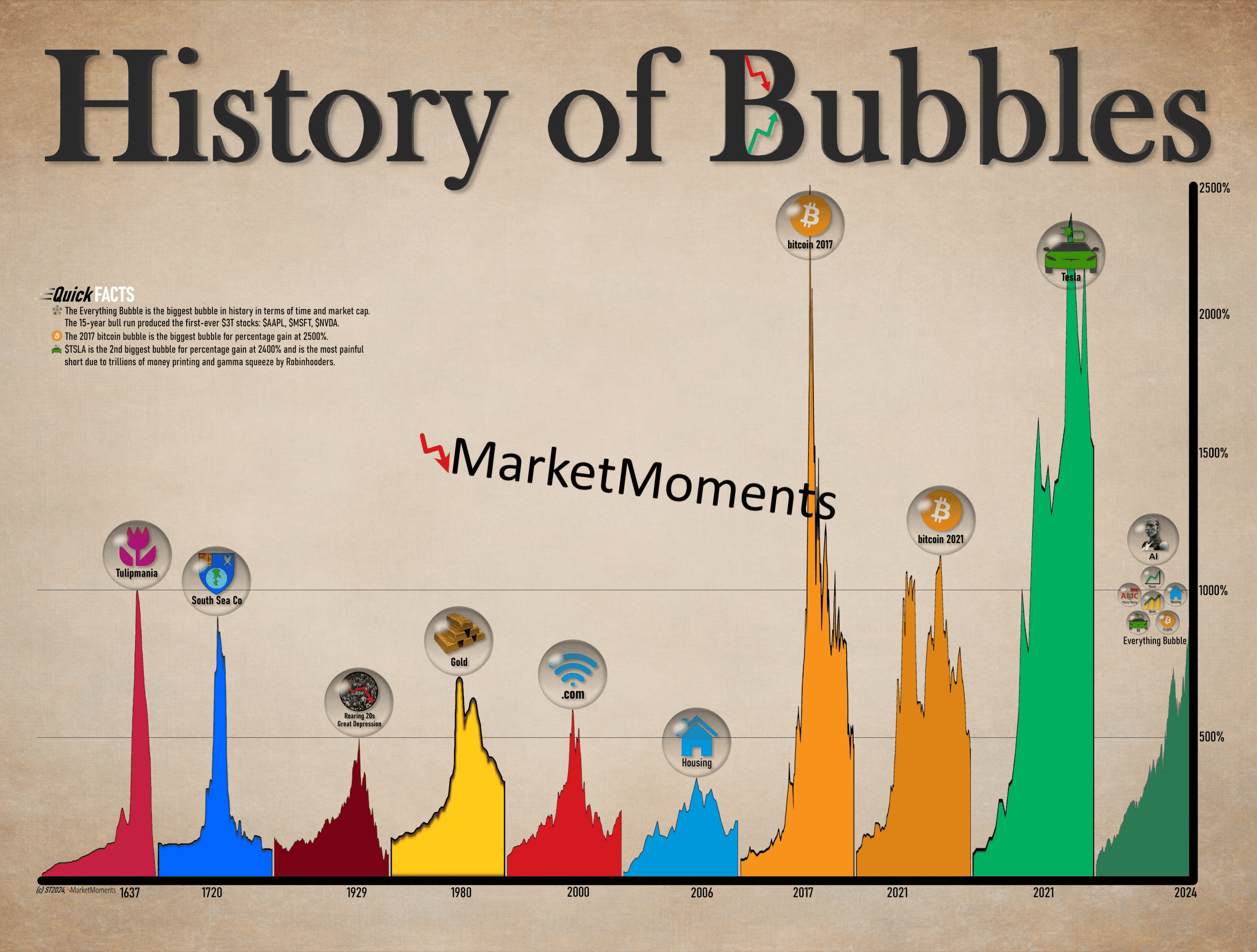

History is a powerful teacher when it comes to the AI bubble, showing that technological breakthroughs often spark speculative frenzies. By examining past events, we see why history demands caution in 2026's AI landscape.

The Dot-Com Bubble of the Late 1990s

The dot-com bubble, peaking around 2000, offers the closest parallel to today's AI bubble. Back then, internet stocks on NASDAQ soared based on "eyeballs" (user traffic) rather than profits. The Nasdaq index dropped nearly 80% when the bubble burst, wiping out trillions. Companies like Yahoo dominated search engines in 1999, but late entrants like Google emerged post-crash to claim 90% market share. Similarly, in 2026, AI leaders like OpenAI face competition, and overinvestment could lead to a shakeout.

Key Lesson: First-movers overinvest, facing bankruptcy, while efficient followers thrive after corrections.

Relevance to AI: Current valuations at 23 times forward earnings for the S&P 500 mirror dot-com highs.

Earlier Manias: Railroads and Electricity

Going further back, the 19th-century railroad boom in the US transformed commerce but led to numerous failures. Investors poured money into tracks and companies, only for overcapacity to cause busts. Electricity in the early 20th century followed suit—innovative, yet early firms collapsed despite long-term benefits to the economy.

These examples highlight a pattern: Infrastructure lags behind hype by decades. In AI, data centers and chips represent this "picks and shovels" phase, but full adoption in industries like transportation could take years, per World Economic Forum insights.

Modern Echoes: Housing and SPAC Frenzies

The 2008 housing bubble assumed endless price rises, much like AI's narrative of inevitable dominance. The SPAC (special purpose acquisition company) boom during the pandemic treated projections as certainties, paralleling AI's focus on potential over earnings. In 2026, with tariffs and migration policies potentially dragging growth, these historical warnings urge vigilance.

History demands caution because bubbles clear excesses, paving the way for sustainable growth. For stock trading in 2026, this means timing entries post-correction for better returns.

Pitfalls to Avoid and Advice from StockProfitClub

Navigating the AI bubble requires avoiding common traps while adopting smart investment strategies. StockProfitClub, dedicated to financial independence through disciplined trading, offers expert guidance tailored for US investors.

Common Pitfalls in the AI Bubble

Chasing Hype Without Due Diligence: Many buy AI stocks based on news buzz, ignoring PE ratios or balance sheets. In 2026, firms like Palantir trade at 177 times forward earnings, a classic overvaluation sign.

Ignoring Market Concentration Risks: Over-reliance on a few NASDAQ giants exposes portfolios to volatility. Diversify beyond tech to include stable sectors like consumer goods.

Assuming Quick Monetization: AI promises high margins, but competition and regulatory hurdles (e.g., SEC rules on data privacy) delay profits.

Neglecting Economic Indicators: Watch Dow Jones for broader signals; rising rates could pop the AI bubble by tightening capital.

Expert Advice from StockProfitClub

To counter these, adopt proven stock investing strategies:

Focus on Fundamentals: Use tools like PE ratios to assess value. For beginners, start with ETFs tracking the S&P 500 for balanced exposure.

Diversify and Hedge: Balance AI holdings with non-tech assets. Consider options trading for protection, learn more in our e-books.

Time Your Investments: History shows post-bubble phases yield the best returns. Wait for valuations to reset, as Jeremy Grantham suggests.

Stay Informed: Follow reputable sources like SEC updates on market risks.

Conclusion

In summary, the AI bubble in 2026 underscores why history demands caution: from dot-com crashes to railroad manias, speculative frenzies inflate prices before corrections restore balance. Understanding the AI bubble's drivers, recognizing historical parallels, and avoiding pitfalls like hype-chasing can safeguard your investments. With practical advice from StockProfitClub, focus on disciplined stock trading and investment strategies for long-term success, whether analyzing 2026 stock picks or building financial independence.

Sign up for our newsletter, enroll in our courses or contact us for personalized advice at https://www.stockprofitclub.com/.