Tesla Delivers Q4 Earnings Surprise, Shares Jump 3% on Strong Margins

Posted on

Stock Analysis

Posted at

Jan 28, 2026

Intoduction

Tesla earnings are here, and the stock jumps 3%, offering a prime opportunity to dissect what this means for your investments. Whether you're a beginner eyeing Nasdaq-listed innovators or a seasoned trader, this article delivers the best Tesla earnings analysis for beginners in USA, helping you achieve financial independence through informed decisions. Discover proven ways to leverage Tesla earnings insights for high returns while minimizing risks, aligned with StockProfitClub's mission to empower disciplined trading.

Understanding Tesla's Earnings Report

Tesla earnings are pivotal events that can sway the entire electric vehicle (EV) sector on the Nasdaq. But what exactly do these reports entail? Let's break it down simply for US investors.

Key Financial Metrics Explained

At the core of any earnings report is revenue, the total money a company brings in from sales. For Tesla's Q4 2025, revenue came in at $24.90 billion, slightly below analyst expectations of $25.11 billion, marking a 3% drop year-over-year. This dip reflects challenges like reduced vehicle deliveries, but it's not all gloom. Earnings per share (EPS) is another crucial metric; it shows profit per stock share. Tesla's adjusted EPS hit $0.50, beating estimates of $0.45, while reported EPS was $0.24, down from $0.66 the previous year. Adjusted EPS excludes one-time items, giving a clearer picture of ongoing operations, think of it as the "clean" profit measure.

Margins tell us about efficiency. Gross margin, the percentage of revenue left after production costs, reached 20.1%, surpassing the 17.1% forecast. This jump highlights Tesla's cost controls amid tariffs and supply chain shifts. Operating margin, after all expenses, stood at 5.7%, a decline but still solid for a growth company. Free cash flow, the money left for investments or dividends, was $1.42 billion, missing estimates but contributing to an annual $6.2 billion.

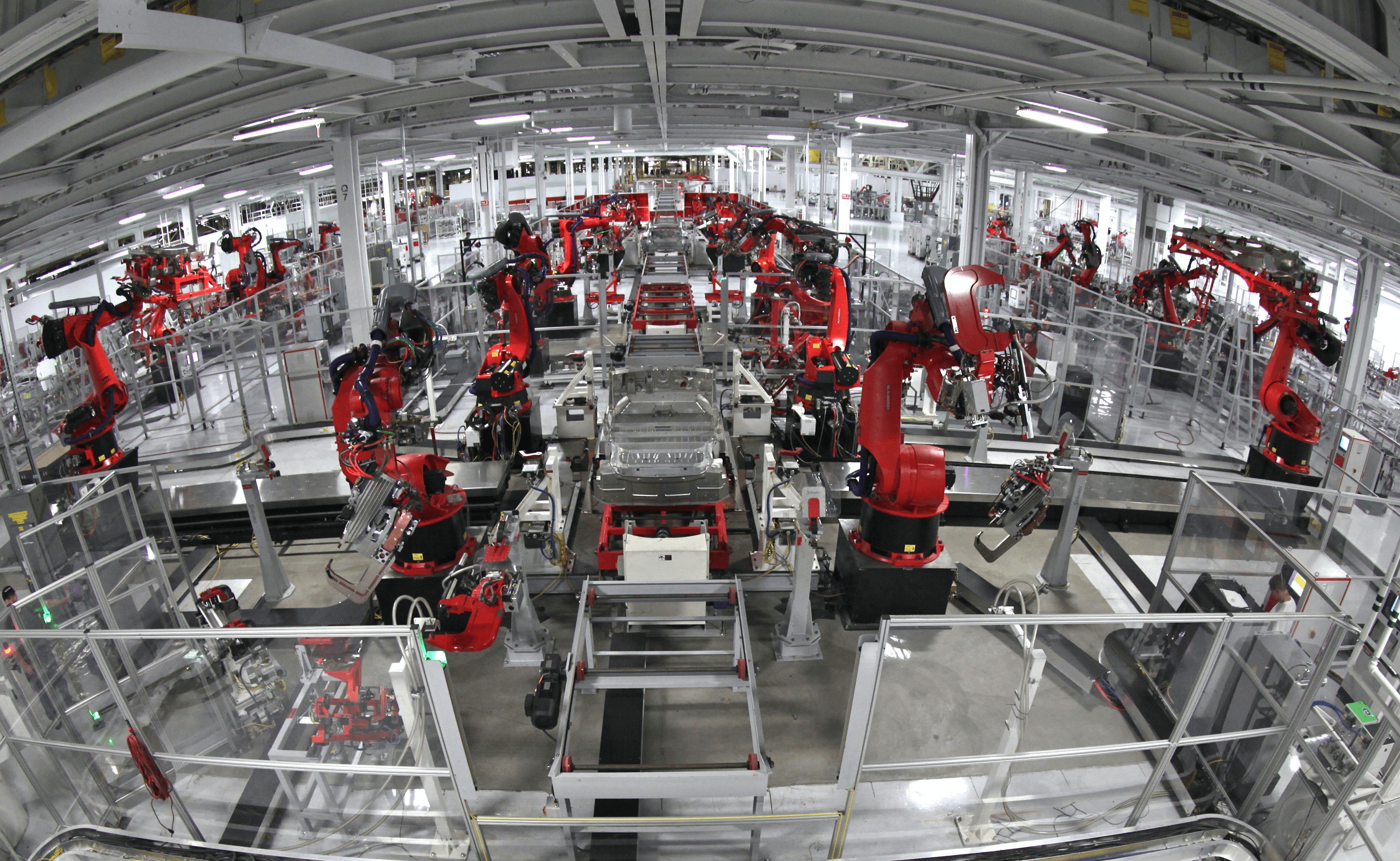

Vehicle deliveries totaled 418,227, down 15.6% from last year, as competition from China's BYD intensified. Yet, Tesla's energy storage business shone, with rapid growth in deployments, making it the fastest-expanding segment.

Forward-Looking Guidance and Innovations

Tesla earnings aren't just backward-looking; they spotlight future plans. CEO Elon Musk emphasized autonomy and robotics during the call. Full Self-Driving (FSD) subscriptions grew to 1.1 million active users, more than doubling in 2025, with a shift to monthly plans only. Robotaxi services are expanding to cities like Dallas, Houston, and Phoenix in early 2026.

Projects like the Cybercab, Tesla Semi, and Megapack 3 are on track for volume production in 2026. The Optimus robot could revolutionize labor, and battery onshoring in Texas and Nevada starts this year, reducing reliance on foreign supplies amid SEC-regulated trade rules.

Have you wondered how Tesla's push into AI and autonomy might impact your portfolio? This Tesla earnings analysis for 2026 stock picks suggests these innovations could drive long-term growth, even if short-term deliveries lag.

Key Benefits and Strategies for US Investors

Tesla earnings are here, and the stock jumps 3%, a signal that smart investors can capitalize on. For US readers trading on NYSE or Nasdaq, understanding these benefits can lead to financial freedom.

Benefits of Tesla Earnings Insights

First, Tesla earnings provide a window into the EV market's health, influencing the Dow Jones and S&P 500. The 3% stock jump post-earnings reflects optimism despite revenue misses, thanks to margin beats and future tech promises. For retirement savers, this means potential high returns in IRAs, where Tesla's growth story aligns with tech sector booms.

Energy business growth offers diversification benefits, unlike pure auto plays, Tesla's storage solutions hedge against oil volatility.

Step-by-Step Strategies

Here's a practical guide to using Tesla earnings for investments:

Review Key Metrics: Start with EPS and margins on sites like Yahoo Finance. If adjusted EPS beats like this quarter's $0.50, consider buying dips.

Analyze Stock Reaction: The 3% jump suggests momentum; use technical charts to spot entry points.

Diversify with Related Plays: Pair Tesla with energy ETFs, given the segment's surge.

Set Risk Limits: Use stop-loss orders per SEC guidelines to protect against volatility.

Long-Term Hold: For 2026 picks, focus on Robotaxi and Optimus, analysts see buying opportunities here.

Real-world example: In past quarters, Tesla's margin improvements mirrored Apple’s, rewarding patient US investors with compounded gains.

What strategies have worked for you in tech stocks? Share in the comments to engage with our community.

For deeper dives, check our internal course: Everything You Need to Become a Profitable Trader in 2026.

Common Mistakes, Expert Tips, and Best Practices

Even with Tesla earnings sparking a 3% stock jump, pitfalls abound for US investors.

Common Mistakes to Avoid

Chasing Hype: Jumping in post-earnings without checking fundamentals, like ignoring the revenue miss.

Overlooking Regulations: Forgetting SEC rules on insider trading or tariffs impacting costs.

Ignoring Diversification: Betting all on Tesla amid BYD competition, risking losses if deliveries drop further.

Neglecting Jargon: Misunderstanding terms like PE ratio (price-to-earnings, gauging if stock is overvalued—Tesla's is high due to growth expectations).

Expert Tips from StockProfitClub

Our experts recommend:

Monitor Energy Growth: With deployments soaring, allocate 10-20% to this for balanced returns.

Use Tools for Analysis: Leverage Investopedia for EPS explanations Investopedia on EPS.

Time Entries Wisely: Buy after pullbacks, as analysts view post-earnings dips as opportunities.

Best practices include regular portfolio reviews, aligning with Fed policies, and focusing on long-tail keywords like best Tesla earnings analysis for beginners in USA for research.

Conclusion

Tesla earnings are here, and the stock jumps 3%, underscoring resilience in a challenging year with delivery declines but margin wins and exciting 2026 prospects like Robotaxi expansions and Optimus advancements. We've covered the fundamentals, benefits, strategies, and tips to avoid pitfalls, all tailored for US investors navigating Nasdaq volatility.

Key takeaways: Focus on adjusted EPS beats, energy growth, and innovation for 2026 stock picks. By applying this Tesla earnings analysis, you can minimize risks and aim for high returns, embodying StockProfitClub's ethos of informed, disciplined trading.

Ready to take action? Join the StockProfitClub community today—sign up for our newsletter, enroll in Everything You Need to Become a Profitable Trader in 2026, or contact us for personalized advice. Your journey to financial freedom starts with one smart trade.