How to Trade Stocks: 5 Steps to Get Started

Posted on

Trading

Posted at

Jan 7, 2026

Choose and Open a Brokerage Account

To begin trading stocks, you need a brokerage account, which acts as your gateway to the stock market. A brokerage is an online platform that allows you to buy and sell securities. Popular choices for beginners include Fidelity, Charles Schwab, Vanguard, Robinhood, E*TRADE, and Interactive Brokers. When selecting one, consider factors like commission fees (many now offer $0 trades), minimum deposit requirements (often none), ease of use, mobile app quality, educational resources, customer support, and additional tools like research reports or robo-advisors.

Compare platforms by reading reviews. For example, Robinhood is known for its simple interface and fractional shares, making it ideal for small investments, while Fidelity offers robust research tools and excellent customer service. Once you've chosen, the signup process involves providing personal details such as your name, address, Social Security number, and employment information for tax purposes. You'll also need to verify your identity with documents like a driver's license or passport. Choose the account type: a standard taxable brokerage account for flexibility, or tax-advantaged ones like a Roth IRA for retirement savings. After approval, which usually takes a few days, you're ready to proceed.

Research and Educate Yourself

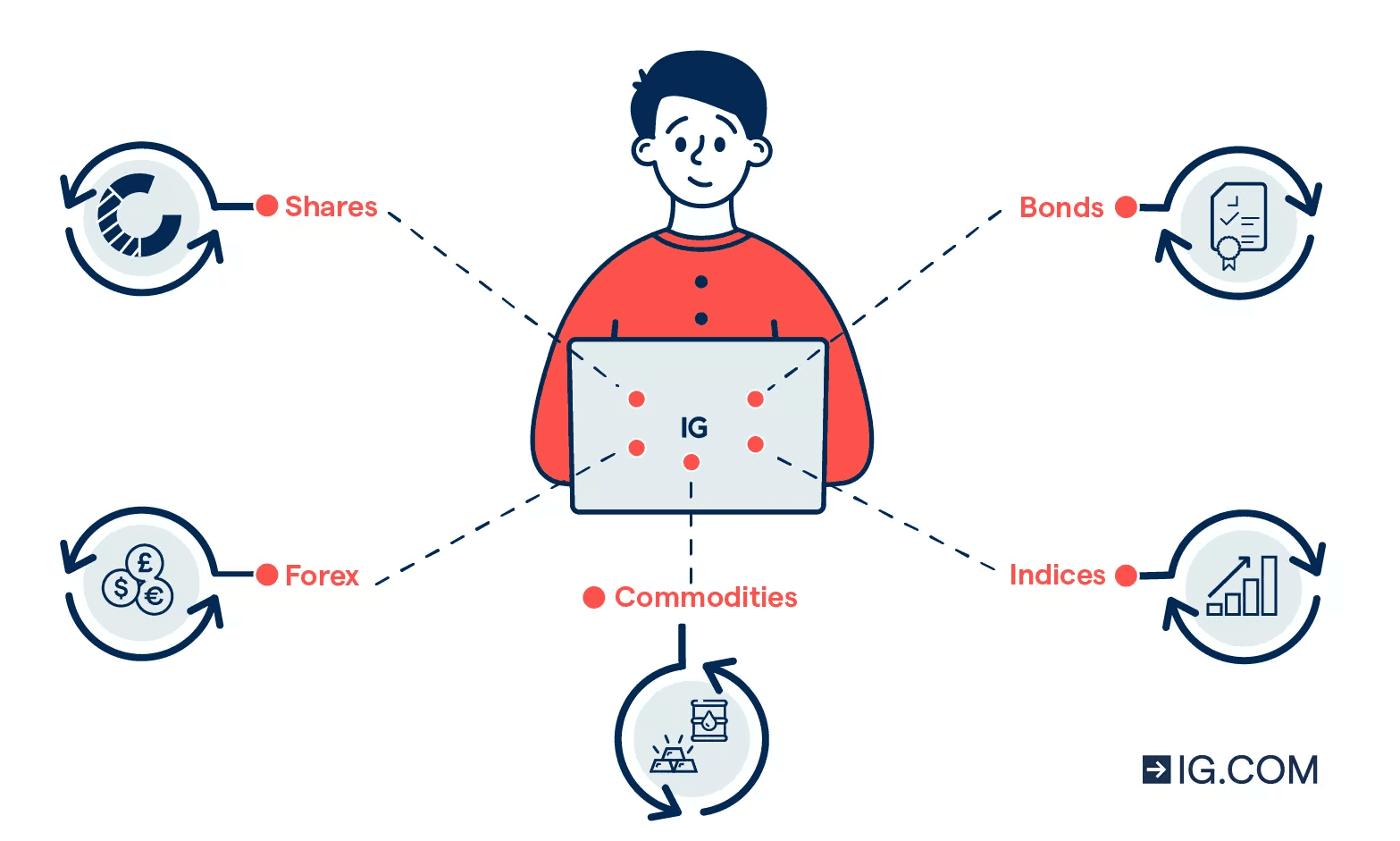

Knowledge is the foundation of successful stock trading. Before risking real money, invest time in learning the basics. Understand key concepts like what stocks represent (ownership in a company), how markets work (supply and demand drive prices), different order types (market vs. limit), and strategies (value investing, growth investing, or day trading).

When researching specific stocks, look at fundamental analysis: review a company's financial statements, earnings per share (EPS), price-to-earnings (P/E) ratio, debt levels, and revenue growth. Use tools like Yahoo Finance, Morningstar, or your broker's platform for charts and data. Consider technical analysis for timing entries, studying price patterns and indicators like moving averages or RSI. Diversification is crucial—don't put all your money in one stock; consider index funds or ETFs for broad market exposure and lower risk.

Fund Your Account

With your account open, the next step is depositing funds. Most brokerages allow transfers via ACH (linked bank account, free and takes 1-5 business days), wire transfers (faster but may have fees), or depositing checks. Some offer instant funding options with debit cards or margin for limited amounts.

Decide how much to start with, many experts recommend beginning small, perhaps $500 to $5,000, to learn without excessive risk. Only invest money you can afford to lose, as stock prices can fluctuate significantly. Emergency funds and high-interest debt should be prioritized first. Once funded, your cash will appear as "settled" after clearance, allowing you to trade. Keep in mind settlement rules: for stocks, trades settle in T+1 meaning funds from sales are available sooner.

Place Your First Trade

Now you're ready to buy stocks. Search for a company using its ticker symbol (e.g., AAPL for Apple). Decide on the number of shares based on your budget and diversification goals. Beginners often start with established companies or ETFs like the SPY (tracks S&P 500).

On the trading platform, select "Buy," choose the order type: a market order executes immediately at the current price, while a limit order only at your specified price or better. You can also set good-til-canceled (GTC) duration or day orders. Review the estimated cost, including any fees, then confirm. For added safety, consider fractional shares if available, allowing investment of exact dollar amounts.

Start conservatively, avoid penny stocks or highly volatile options initially. Understand risks like market volatility, and never invest based on hype alone.

Monitor and Manage Your Portfolio

Trading doesn't end with buying, ongoing management is key. Regularly check your portfolio's performance via your brokerage app or website, tracking gains/losses, dividend payments, and overall allocation.

Set investment goals (e.g., long-term growth) and review quarterly. Rebalance if one asset dominates due to growth. Use tools like stop-loss orders to automatically sell if a stock drops to a certain price, limiting losses. Stay informed with news from CNBC, Bloomberg, or company earnings calls, but avoid emotional reactions to short-term fluctuations.

Long-term buy-and-hold strategies often outperform frequent trading for beginners, as they reduce fees and taxes. Consider dollar-cost averaging: investing fixed amounts regularly regardless of price. Track taxes, keep records for capital gains reporting. Continue educating yourself and adjust strategies as you gain experience.