Exploring Stock Trading Styles: A Spotlight on Fundamental Analysis

Posted on

Trading

Posted at

Jan 8, 2026

Introduction

Fundamental analysis involves evaluating a company's intrinsic value by examining key business events and financial metrics to decide which stocks to purchase and the optimal timing. This approach is typically linked to long-term investing, often described as buy-and-hold. That said, certain situations allow fundamental insights to drive significant short-term gains.

Overview of Major Trading Approaches

To better understand fundamental analysis, let's first outline the primary styles of stock trading:

Scalping: Scalpers execute numerous trades throughout the day, aiming to capture tiny profits from each by capitalizing on the difference between buy and sell prices.

Momentum Trading: These traders target stocks experiencing strong price movements in one direction with heavy trading volume, hoping to profit by following the trend.

Technical Trading: Technical analysts rely on price charts and patterns, looking for indicators like convergences or divergences to signal potential buys or sells.

Fundamental Trading: Traders using this method base decisions on in-depth company analysis, focusing on events such as earnings releases, stock splits, mergers, or acquisitions.

Swing Trading: Swing traders, often overlapping with fundamentalists, maintain positions for several days or weeks. Many fundamental traders fall into this category, as meaningful shifts in company fundamentals usually take time to impact stock prices enough for profitable exits.

Beginners may try various styles, but it's advisable to focus on one that aligns with your knowledge, experience, and commitment to ongoing learning and practice.

Key Fundamental Metrics and Their Role in Trading

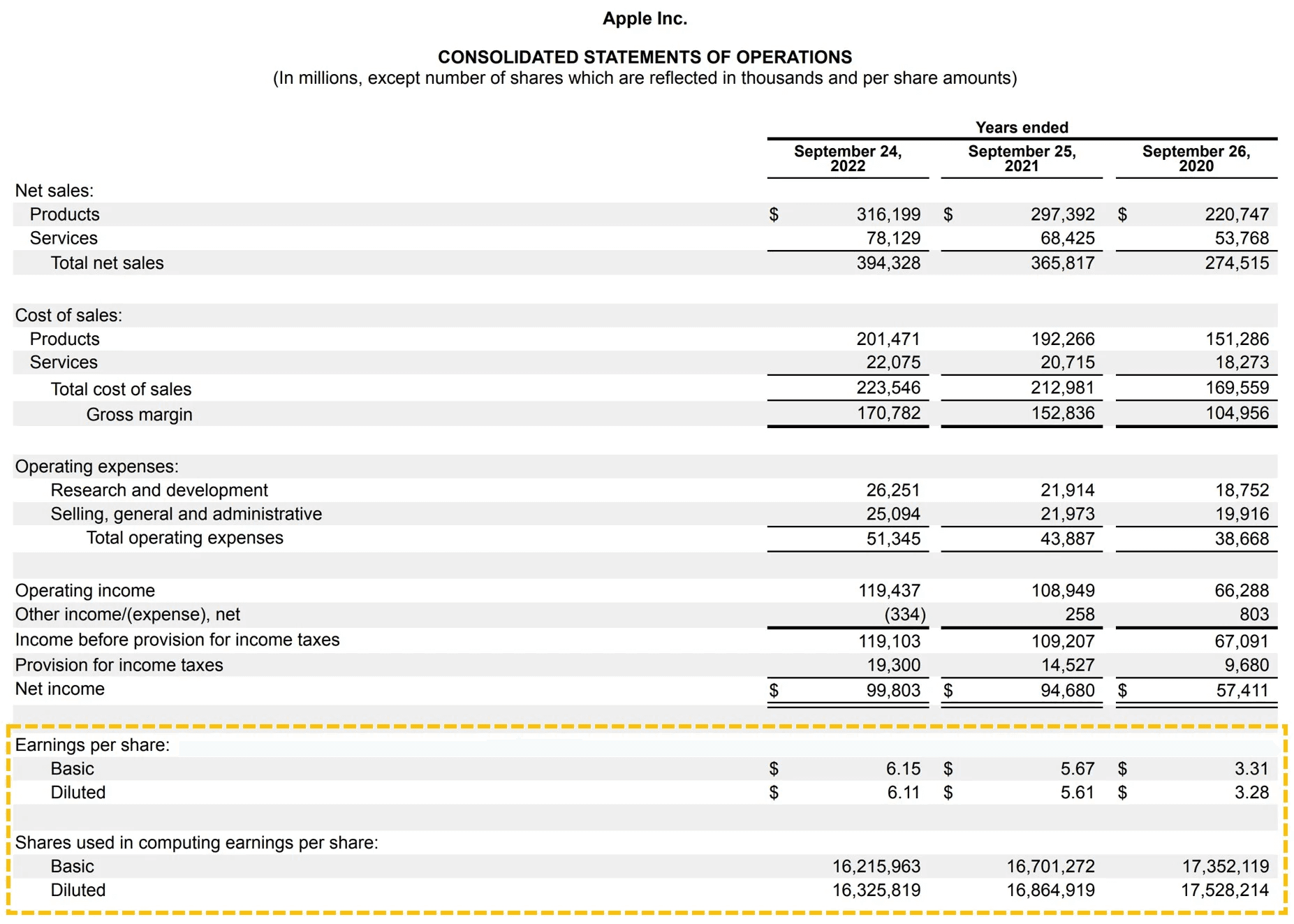

Equity investors commonly track metrics like earnings per share (EPS), sales revenue, and cash flow in fundamental analysis. These numbers come from financial reports such as income statements, cash flow statements, and balance sheets. Ratios like return on equity (ROE) or debt-to-equity (D/E) also play a crucial role. Traders might spot opportunities when unexpected results surprise the market.

Among the most monitored events are quarterly earnings reports and changes in analyst recommendations. However, gaining an advantage here is challenging due to intense competition from professional investors.

Earnings Reports

A critical period is just before the official release, when companies signal if they will meet, beat, or miss projections. Sudden announcements often trigger immediate trading activity due to potential short-term price swings.

Analyst Recommendations

Upgrades or downgrades from influential analysts can create trading windows, especially sharp downgrades that lead to rapid price drops, requiring fast action for short positions.

These events tie into momentum strategies, where unexpected news drives high-volume trading in one direction.

Savvy fundamental traders often seek lesser-known details about upcoming events, using past patterns around stock splits, mergers, acquisitions, or restructurings to anticipate market reactions.

Capitalizing on Corporate Events

Stock Splits

In a 2-for-1 split, a $20 share becomes two $10 shares without altering the company's total value. Some believe lower prices attract more buyers, boosting demand, though the underlying value remains unchanged.

Successful split trading requires pinpointing the current phase in historical patterns: gains often occur before announcements and during pre-split rallies, while declines follow post-announcement and post-split periods. Skilled traders may enter and exit multiple times around these phases.

Mergers, Acquisitions, and Restructurings

The saying "buy on rumor, sell on news" frequently applies here, with prices surging on speculation and dropping after confirmation.

Experienced traders avoid holding through the full cycle, instead capturing gains during rumor-driven momentum and possibly trading multiple times. Post-announcement, shorting the acquirer's stock is common, as such deals are rarely viewed favorably for the buyer.

Restructurings, like replacing an underperforming executive, can spark positive surprises if unexpected.

For takeover targets, prices often stabilize near the offer level, limiting movement. The prime opportunities lie in the rumor phase, where speculated terms fuel volatility.

While these events carry high risk due to extreme swings, they also offer some of the richest rewards for prepared fundamental traders.

Key Takeaways

Sophisticated traders often employ pattern-based models to predict movements around earnings, analyst changes, splits, and M&A events. These resemble technical charts but focus on recurring behaviors near specific triggers rather than complex math.

Accurate phase identification and anticipation of price reactions increase success rates. Though hype can amplify risks, studying historical patterns helps manage them effectively. Ultimately, thorough research is essential before engaging in these strategies.