Demystifying Leveraged Volatility ETFs

Posted on

Trading

Posted at

Jan 20, 2026

Introduction

Leveraged volatility exchange-traded funds (ETFs) are specialized investment products that aim to provide amplified exposure to changes in market volatility measures. These ETFs use derivatives such as futures contracts, swaps, and options, along with borrowed capital, to achieve multiples, typically 1.5x or 2x, of the daily performance of a volatility benchmark. The primary benchmark is often the CBOE Volatility Index (VIX), which reflects expected short-term volatility in the S&P 500, or indices based on VIX futures contracts.

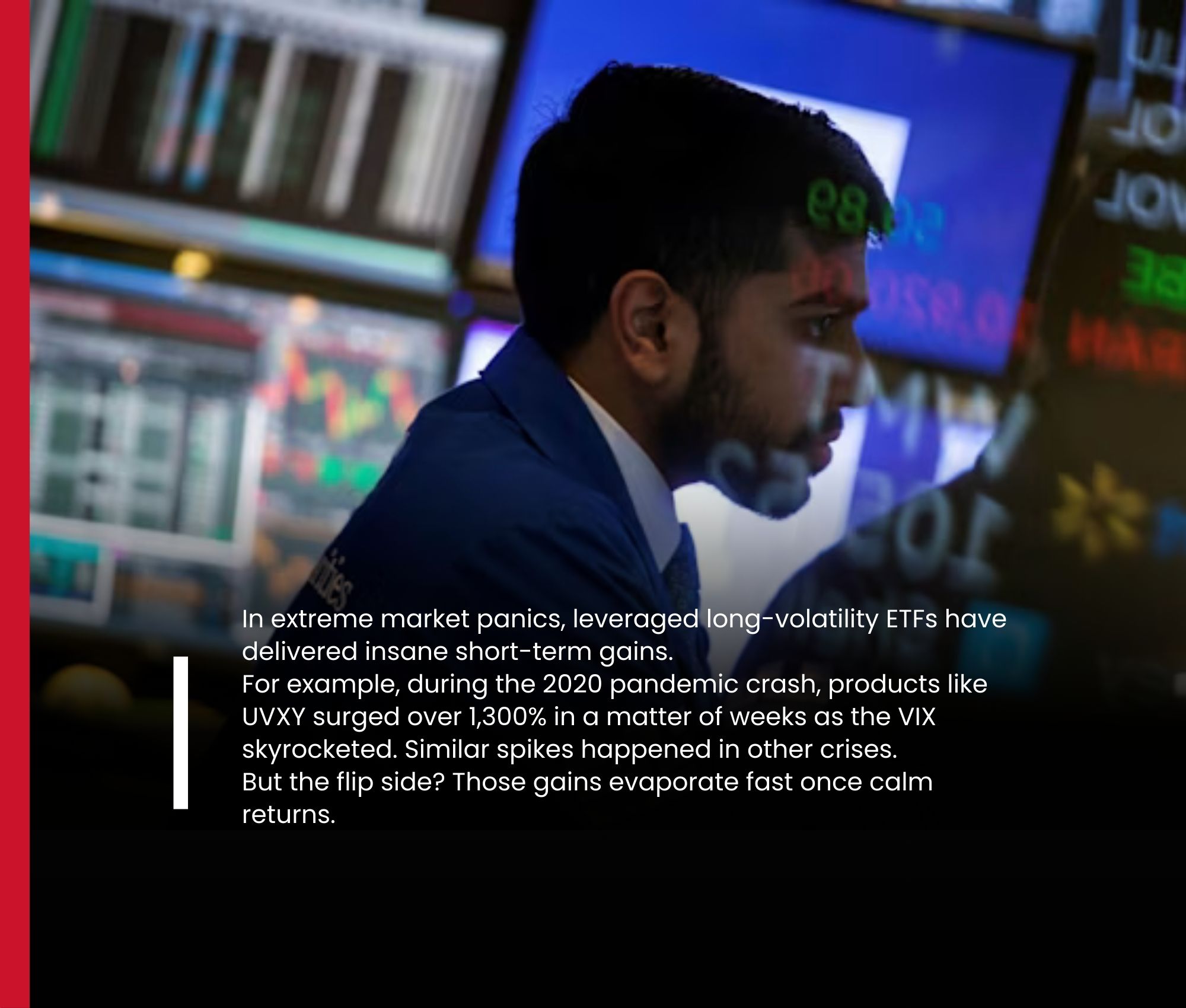

These products can perform well in short-term periods of market turbulence, as they tend to rise when volatility increases. However, they reset their leverage daily, which makes them appropriate only for short-term trading or hedging strategies, not for long-term holding. Over extended periods, structural factors like compounding and futures market dynamics can lead to performance divergence from the underlying index.

Key Takeaways

Leveraged volatility ETFs target multiples of the daily returns of a volatility index, such as the VIX.

They rely on derivatives and leverage to amplify exposure.

Due to daily rebalancing, these ETFs experience value decay over time, regardless of the underlying index's direction.

They are designed for experienced traders and carry high risk, making them unsuitable for most long-term investors.

What Is a Leveraged Volatility ETF?

Traditional ETFs track an index by holding a portfolio of securities that mirrors the index's composition, such as an S&P 500 ETF owning shares in proportion to the index's weights. Volatility ETFs differ by focusing on market volatility, the degree of price variation, rather than directional price movements. They allow investors to gain exposure to uncertainty in the markets.

Since the VIX is a calculated index and not a tradable asset, volatility ETFs use derivatives like futures contracts to approximate its performance. Leveraged volatility ETFs extend this by incorporating leverage to magnify daily returns. For instance, a 2x leveraged ETF aims to deliver twice the daily change in its benchmark. If the underlying volatility index rises 3% in a day, the ETF targets a 6% gain (before fees), but a 3% drop would result in a 6% loss.

Market volatility refers to the rate of price changes in assets over a period. High volatility implies larger, more frequent swings, while low volatility suggests stability.

How Leveraged Volatility ETFs Work

Measuring Volatility

The VIX, known as the "fear gauge," calculates implied volatility from S&P 500 options prices, projecting 30-day forward volatility. It typically ranges from 10-20 in calm markets but can surge to 40 or higher during stress, such as reaching 60 in early 2025 or a record 87 in 2008. Other indices include VXN for the Nasdaq 100 and VXEEM for emerging markets.

Trading Volatility

Direct investment in the VIX is impossible, so exposure comes via:

VIX futures: Contracts betting on future VIX levels.

VIX options: Rights to buy or sell VIX futures.

Volatility ETFs/ETNs: Products tracking VIX futures indices.

ETFs simplify this by managing futures internally.

Adding Leverage to the Mix

Leveraged versions use debt and derivatives to amplify exposure beyond the fund's assets. For example, a 2x ETF might use swaps and futures to create $200 in exposure from $100 in assets, targeting twice the daily return. Daily rebalancing maintains the leverage ratio, but this can cause divergence over time due to compounding.

Risks of Leveraged Volatility ETFs

Amplified Losses: Leverage magnifies both gains and losses, leading to rapid capital erosion in adverse moves.

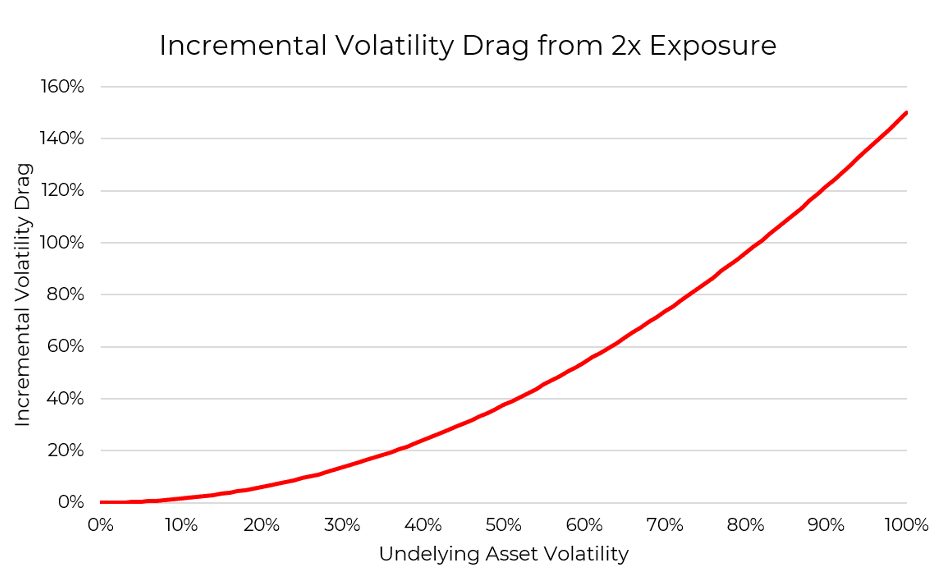

Volatility Drag: Daily compounding causes returns to depend on the path of price changes, often resulting in decay during sideways or volatile periods, even if the index ends flat.

Contango Decay: In futures markets where longer-term contracts are pricier (contango), rolling positions incurs costs, exacerbating decay.

Volatility of Volatility: Sudden shifts in volatility can cause extreme ETF price swings, measured by the VVIX.

Counterparty Risk: Reliance on OTC derivatives exposes funds to default by counterparties.

Liquidity Risk: Stressed markets can reduce derivative liquidity, impairing tracking accuracy.

The illustration below shows how volatility drag affects leveraged ETFs:

Examples of Leveraged Volatility ETFs

ProShares Ultra VIX Short-Term Futures ETF (UVXY): Provides 1.5x exposure to the S&P 500 VIX Short-Term Futures Index, rolling first- and second-month VIX futures for a one-month average maturity. Expense ratio: 0.95%.

2x Long VIX Futures ETF (UVIX): Targets 2x daily performance of the Long VIX Futures Index, using daily rolls of short-term VIX futures. Expense ratio: 2.19%. As of January 2026, it has shown significant volatility, with a one-year return of -81.33%.

ProShares Short VIX Short-Term Futures ETF (SVXY): An inverse product offering -0.5x exposure to the S&P 500 VIX Short-Term Futures Index, betting against volatility. Expense ratio: 0.95%.