Why zSpace (ZSPC) Could Be the EdTech Breakout Stock of 2026

Posted on

Stock Analysis

Posted at

Jan 25, 2026

Introduction

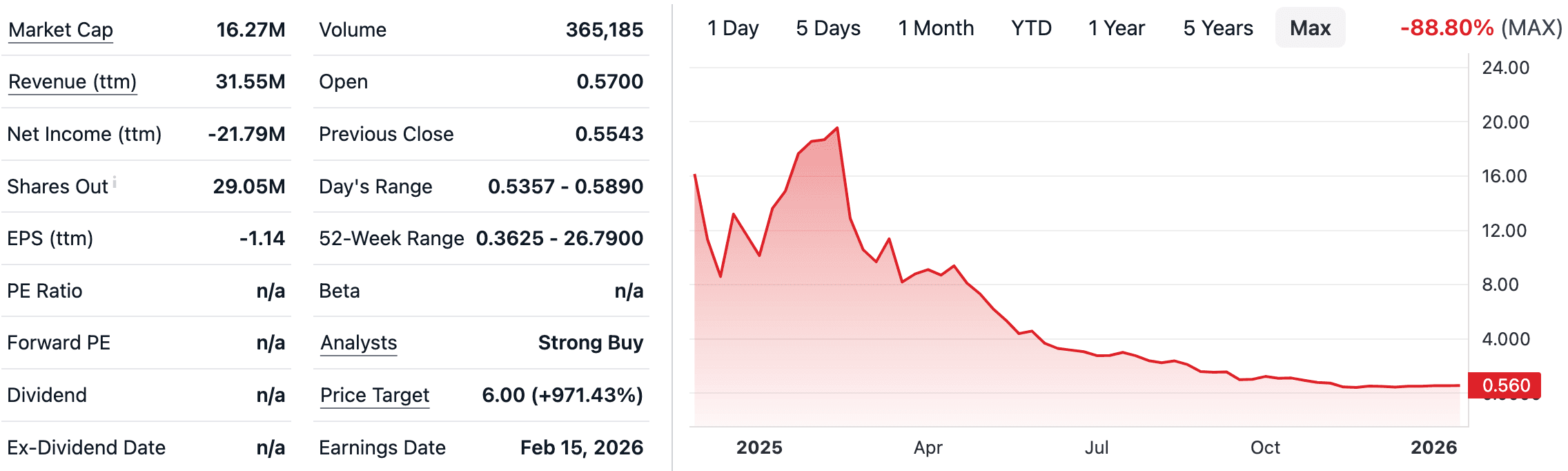

In the rapidly evolving landscape of educational technology, where immersive learning experiences are transforming classrooms worldwide, zSpace, Inc. (NASDAQ: ZSPC) stands out as a pioneer in augmented reality and virtual reality solutions. Trading at around $0.55 per share with a modest market cap of just $16.27 million, this under-the-radar stock has caught the eye of analysts with a staggering price target of $6.00, implying a potential upside of over 971%. But what makes zSpace so compelling at this price point?

Company Overview

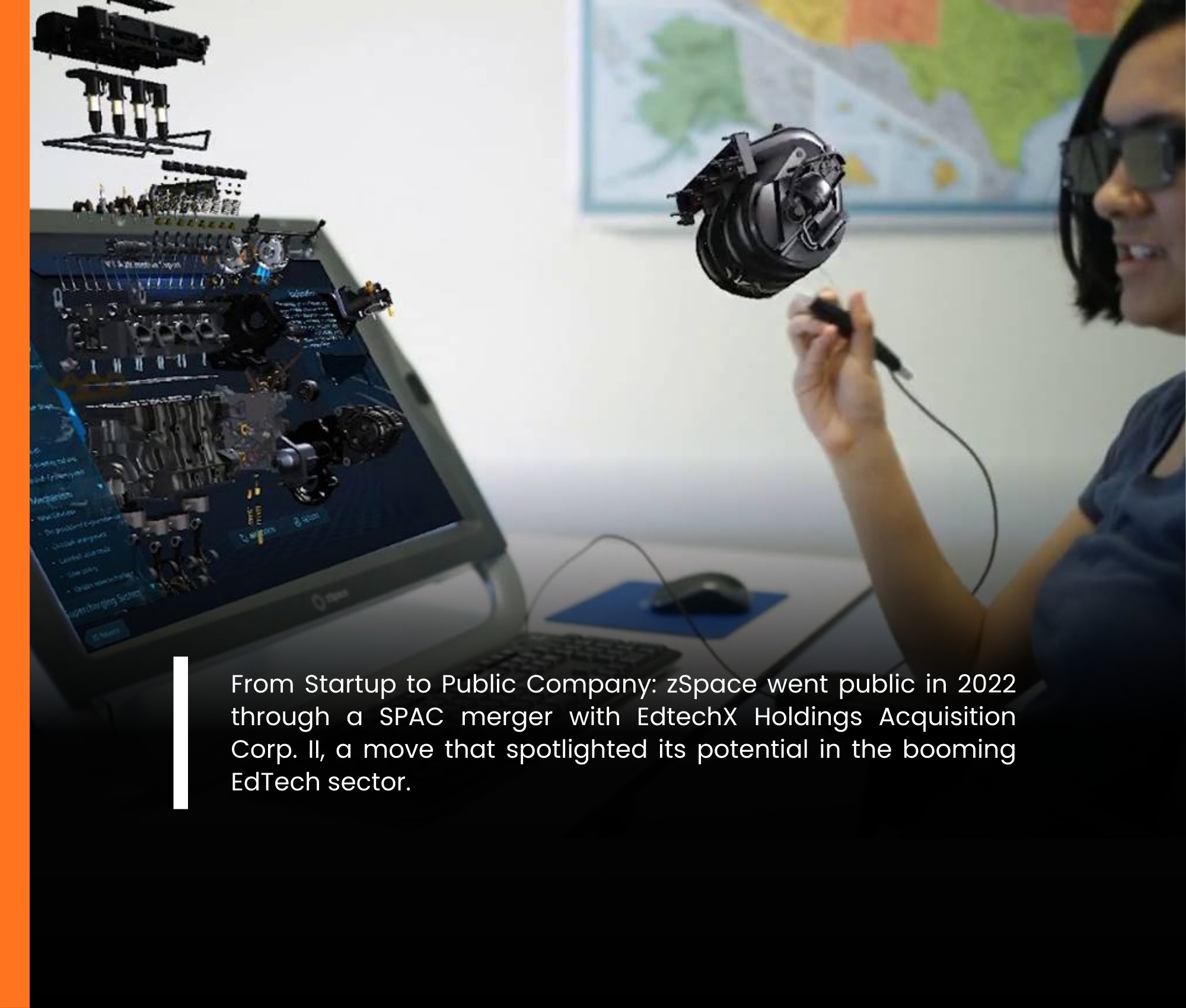

Founded in 2007 and headquartered in San Jose, California, zSpace, Inc. is a technology firm specializing in AR and VR platforms designed specifically for education. The company's mission is to deliver hands-on, experiential learning that boosts student engagement and outcomes without the need for cumbersome headsets or glasses. Its flagship offerings include all-in-one laptops and displays that enable interactive 3D experiences, educational apps, platform management software, and tools like StudioA3 for creating custom content. Targeted at K-12 schools and career and technical education programs in the U.S. and internationally, zSpace's solutions cover STEM subjects, vocational training, and more, allowing students to dissect virtual organs, explore space, or simulate mechanical engineering in a risk-free environment.

With over 70 patents under its belt and recognition as a "Cool Vendor" by Gartner, zSpace has positioned itself at the intersection of education and cutting-edge tech. The platform's evidence-based approach has been shown to improve achievement in science and math, making it a vital tool for modern classrooms facing challenges like remote learning and skill gaps in the workforce.

Financial Snapshot

zSpace's latest financials paint a picture of a growth-stage company navigating challenges while building momentum. For the trailing twelve months, the company reported revenue of $31.55 million, reflecting steady demand for its EdTech solutions. However, it posted a net income loss of -$21.79 million, resulting in an EPS of -$1.14, which highlights ongoing investments in R&D and market expansion amid a competitive landscape.

The stock's 52-week range from $0.3625 to $26.79 indicates volatility, but its current trading volume of 365,185 shares and an open price of $0.57 suggest liquidity for retail investors.

Why It's Interesting at This Price

At approximately $0.55 per share, zSpace represents a classic value play in a high-growth sector. The EdTech market, driven by AR/VR adoption, is projected to expand significantly, with digital holography and immersive learning tools at the forefront. Analysts' "Strong Buy" consensus and $6.00 price target (though some forecasts range from $0.91 to $3.15) point to substantial upside, potentially fueled by upcoming earnings on February 15, 2026.

The stock's low valuation, trading well below its revenue multiple, offers a margin of safety for investors betting on recovery. Amid broader market trends like increased funding for STEM education and post-pandemic shifts toward interactive learning, zSpace's niche focus could lead to partnerships or acquisitions. Recent price gains, such as a 5.71% uptick in early January 2026, hint at building momentum. For risk-tolerant investors, this price level minimizes downside while maximizing exposure to a potential multibagger in an industry where competitors like Meta and Apple are investing billions.

Future Prospects

Looking ahead, zSpace is well-positioned to capitalize on global trends in experiential education. With expected earnings growth from -$0.95 per share in 2025 to positive territory by 2031, and revenue projections climbing to $41.9 million, the company could achieve profitability through scaled adoption. Innovations in hardware-free AR/VR and expansions into international markets could drive market share gains.

Challenges remain, including competition and the need to boost market cap for Nasdaq compliance, but positive analyst sentiment and institutional inflows suggest optimism. If zSpace delivers strong Q4 results or announces key deals, the stock could surge. In summary, at its current price, zSpace isn't just an investment, it's a bet on the future of learning, with the potential to reward those who see beyond the numbers.