Why Hain Celestial (HAIN) Might Be the Organic Food Bargain of 2026

Posted on

Stock Analysis

Posted at

Jan 22, 2026

Introduction

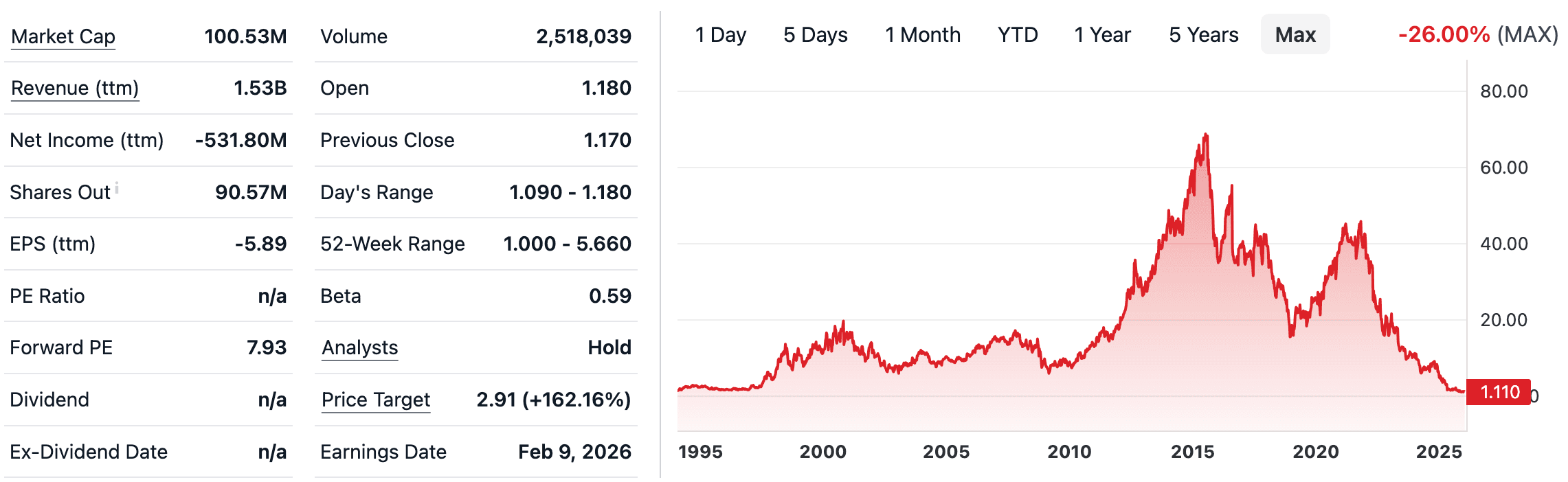

The Hain Celestial Group, Inc. (HAIN) stands out as a quiet contender in the better-for-you consumer goods space. Trading at around $1.11 as of January 21, 2026, this once-high-flying stock has plummeted from its 52-week high of $5.66, drawing attention from value hunters seeking turnaround plays. With a market cap hovering near $106 million, HAIN represents a company deeply embedded in the growing demand for natural, organic, and health-focused products. But is this steep discount a trap or an opportunity?

Company Overview

Founded over three decades ago, Hain Celestial has built a portfolio of iconic brands that cater to health-conscious consumers worldwide. From snacks like Terra chips and Garden of Eatin' to baby foods under Ella's Kitchen, beverages such as Celestial Seasonings teas, and personal care items from Alba Botanica, the company emphasizes organic, non-GMO, and sustainable products. Operating across North America, Europe, and beyond, Hain focuses on categories like snacks, baby & kids foods, beverages, meal preparation, and personal care, all aligned with ESG principles to nourish families while nurturing the planet.

What sets Hain apart is its commitment to innovation in healthier living. Recent launches include convenient, nutrient-packed options for New Year's resolutions, reflecting a strategy to blend taste with wellness. Despite market headwinds, brands like Ella's Kitchen maintain market leadership in the U.K., underscoring Hain's enduring appeal in a sector projected to grow as consumers prioritize transparency and nutrition.

Recent Financial Performance

Hain Celestial's fiscal first quarter of 2026 painted a picture of resilience amid challenges. Net sales reached $368 million, a 7% decline year-over-year, but organic net sales trends showed sequential improvement in both North America and International segments. Gross profit margins expanded thanks to cost discipline and pricing initiatives, though the company reported an EPS of ($0.08), missing estimates by $0.04. A negative net margin of 34.69% highlights ongoing profitability pressures, exacerbated by high debt and competitive dynamics from both niche startups and big players upgrading their offerings.

The stock's trajectory reflects these struggles: down over 80% in the past year, with shares dipping to a 52-week low of $1.00. However, interim CEO Alison Lewis emphasized progress in streamlining costs, reducing SG&A expenses, and laying foundations for growth, with early benefits from portfolio optimization and innovation. Upcoming Q2 results on February 9, 2026, will be a key test of this momentum.

Undervalued with Turnaround Potential

At current levels, HAIN trades at a forward P/E of just 8.4x and appears undervalued compared to peers, with analysts' average one-year price target at $2.46, implying over 100% upside from $1.11. Forecasts range from $1.32 to $5.25, reflecting optimism around a potential rebound driven by marketing investments and brand strength.

The allure lies in Hain's niche in the organic boom: as consumers shift toward sustainable eating, the company's streamlined portfolio and deleveraging efforts could unlock value. Recent stock pops, like an 8.48% gain tied to improved sentiment, suggest bargain hunters are circling. For contrarians, this depressed valuation offers a high-reward setup if management executes on stabilizing sales and boosting profitability, potentially turning a "dead stock" perception into a revival story.

Betting on a Healthier Tomorrow

Looking ahead, Hain Celestial aims for back-half fiscal 2026 improvements, with EPS growth projected at 37.9% annually over five years and modest revenue upticks. Analysts anticipate stronger performance from innovation and a $2 million Q2 marketing boost, positioning the company to capitalize on wellness trends. If successful, HAIN could rebound toward $2.03 by December 2026, per some forecasts.

Yet, risks abound: declining revenues, competition, and geopolitical uncertainties could exacerbate downside, with EPS potentially dropping 91.91% next year if trends worsen. Institutional ownership makes it vulnerable to sentiment shifts, and while cheap, it's "cheap for a reason"—low returns on capital and shaky fundamentals demand caution. For investors, HAIN embodies high-stakes value investing: a potential multi-bagger if the turnaround clicks, but a value trap if not. As always, due diligence is key in this evolving organic landscape.